According to Turner & Townsend, a professional services firm with over 10,000 people in 48 countries, economic resilience, strong construction activity, and stretched labor supply in the U.S. have led to stubborn cost escalation, and this is predicted to average 4.2 percent across North America in 2024.

In Turner & Townsend’s International Construction Market Survey 2024 report, New York City retained its position as the most expensive market to build in for the second year running, with an average cost of $5,723 per square meter (m2), up 5 percent compared with 2023. According to the report, cost escalation in the city is being driven partly by buoyed demand in residential and commercial property — the cost of a high-rise, premium office block has reached an average of $10,660 per m2.

San Francisco, California, followed closely behind in the rankings at $5,489 per m2. The top 10 also included Los Angeles, California; Boston, Massachusetts; Seattle, Washington; and Chicago, Illinois.

In Mexico, the report said the promise of increasing demand for components in the U.S. and Canada is resulting in heightened investment in manufacturing, leading to high cost escalation of over 10 percent in some areas.

| Your local Komatsu America Corp dealer |

|---|

| WPI |

| Kirby-Smith Machinery |

| WPI |

| Kirby-Smith Machinery |

Canada is also seeing robust investment in manufacturing facilities and data centers, with firms leveraging competitive rates on land outside of major metropolitan areas, Turner & Townsend said. As in the U.S., this pipeline of work adds to growing concerns about reduced labor capacity across the Canadian construction sector. Major infrastructure projects are competing for scarce resources and insolvencies are impacting overall supply chain capacity.

Sustained investment is placing a squeeze on already tight labor markets. According to the report, North America ranks as the world’s most expensive region for construction labor at an average of $75 per hour, up 7.1 percent since last year.

While the majority of North American markets are proving resilient, Turner & Townsend noted that political uncertainty around the U.S. election, mixed with strong demand and increasingly acute labor shortages, could begin to curb growth and the capacity of the construction sector. The firm stressed the need to assess supply chains and pipelines in key markets to avoid labor bottlenecks, as well as the importance of investing in digitalization and productivity improvements to increase efficiency and reduce reliance on stretched labor forces.

“Even in the face of high prices and interest rates, economies across North America are very resilient and future opportunities for construction are plentiful, particularly in America and Mexico,” said Lisa Woodruff, Turner & Townsend’s Executive Vice President and North America Head of Real Estate. “The region is set to be a beneficiary of the global shift towards nearshoring and key growth areas, including advanced manufacturing, life sciences, healthcare, and data centers, are fueling construction pipelines across North America.”

London re-entered the top 10 rankings in the 10th position, with an average cost of $4,473 per m2. Turner & Townsend said high costs in the U.K. are being driven by factors such as the persistent and growing capacity squeeze and skills shortage in the sector.

Worldwide, as in North America, the report said deglobalization trends and nearshoring are seeing growth and investment in manufacturing, especially in emerging international markets such as Malaysia, Indonesia, Nigeria, Brazil, and Mexico. Labor constraints remain a significant inflationary factor globally, with all but three of the markets surveyed reporting an impact from skilled labor shortages.

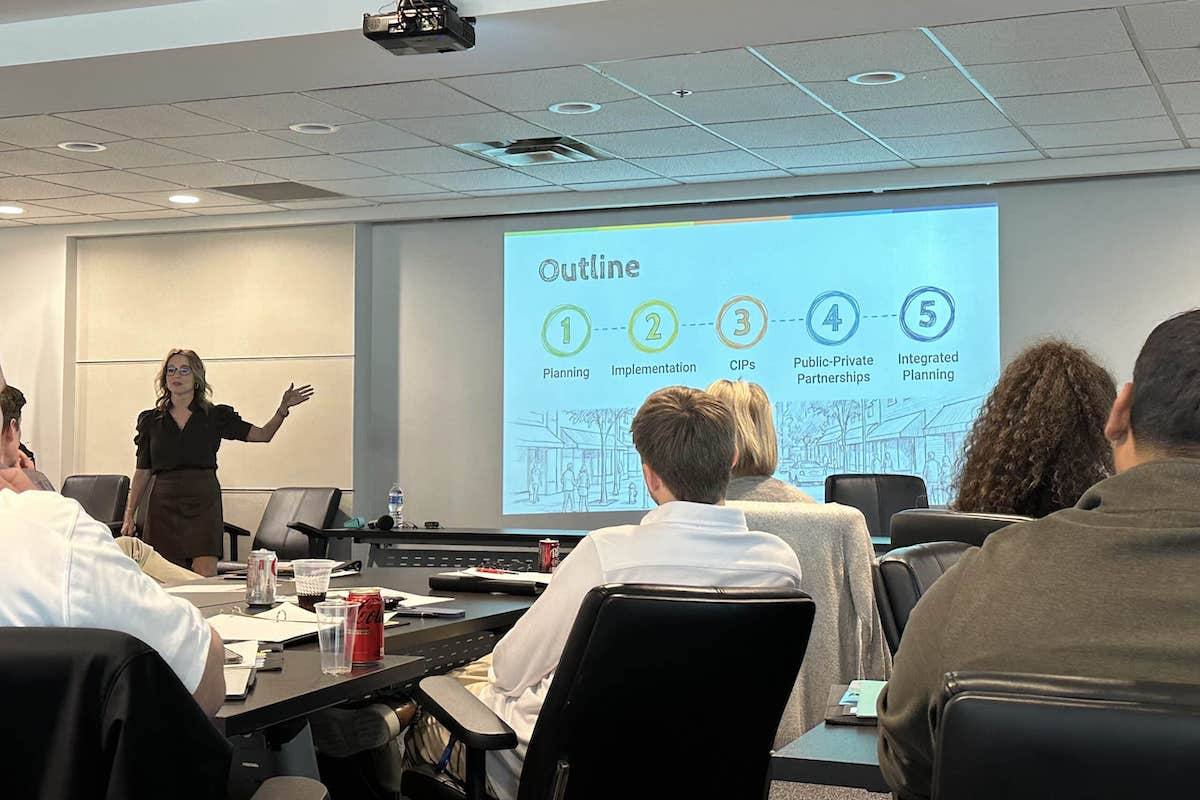

The report compiled data from Turner & Townsend teams in 91 global markets, measuring input costs for materials and labor to calculate the average cost per m2 across 11 construction types, including advanced manufacturing sectors and commercial offices. To read the full report, visit publications.turnerandtownsend.com/international-construction-market-survey-2024/.