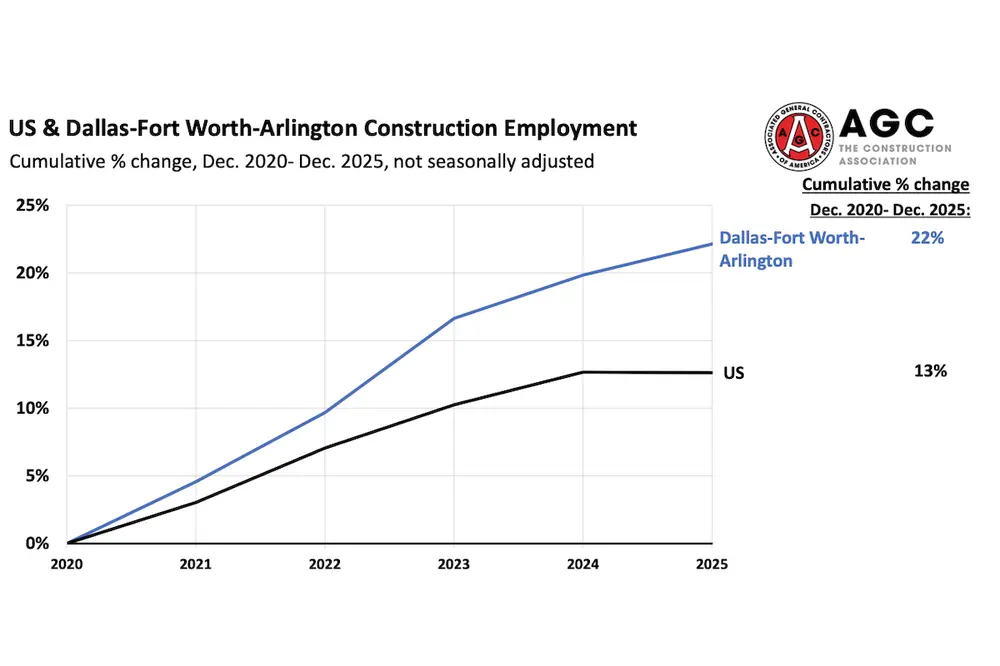

The construction industry in Texas has emerged from the pandemic as a formidable growth engine. With an extremely strong year-over-year job growth rate of 8.3 percent — just behind the region's incredible overall job growth rate of 8.9 percent — the construction sector stands as a pillar of economic strength in a robust economic landscape. Employment in construction is growing year-over-year at a rate of 3.5 percent, which compares favorably to the total employment rate change of 2 percent.

Usually, and in many other regions throughout the U.S., the heightened demand for construction services leads to intense competition for workers, driving wages upward and intensifying hiring competition while straining project budgets and completion timelines. So far, Texas’ labor force gains have mitigated the effect of these pitfalls. The local construction industry seems to hold an enviable position, with a healthy workload and the labor resources to complete it.

A close look at the national construction industry paints a bleaker picture than we see in Texas and other southeastern states. Although buoyed by a sturdy quarter overall, construction at the national level experienced a slight dip in spending, with a mere 1 percent increase over the full year. After factoring in inflation, this suggests a decline in real dollar investment. It is a potent example of the selective pressures bearing down on various construction market segments and shades encouraging data on the local region. One concern might be that, with labor shortages elsewhere, the region’s contractors could be tempted to leave for the markets offering a premium for their skills.

In Marcum’s most recent construction survey analyzing Q4 of 2023, the Commercial Construction Index, Marcum Chief Construction Economist Anirban Basu suggested that price escalations have leveled off to offer some relief, particularly in the later parts of the year. Yet, despite these tailwinds, including global supply chain improvements and a reduction in global demand, commodity prices persist at levels approximately 38 percent higher than those seen at the pandemic's outset.

| Your local Trimble Construction Division dealer |

|---|

| SITECH Allegheny |

| SITECH Northeast |

| SITECH Allegheny |

| SITECH Northeast |

Even with the region’s excellent recent performance, keeping the labor shortages facing other parts of the country in mind would be prudent. In the states facing a long-term labor crunch, the urgency to attract and retain skilled labor has necessitated inventive hiring strategies. Joseph Natarelli, Marcum's National Construction Leader, underscored the importance of closely watching market conditions and actively attempting to overcome labor woes. For contractors, that might mean doubling down on workforce development, apprenticeships, and community engagement efforts to entice the next generation into the trades while further developing the existing workforce. For construction firms in Texas, though, the main concern at this time might be how to best capitalize on such strong industry performance.

While all eyes remain fixed on the Federal Reserve’s monetary policies, most regions will be hoping for falling rates to kickstart activity. If that happens, Texas’ good post-pandemic record may get even better. Marcum's survey of the national industry reveals that industry leaders feel the need to stay alert and flexible in response to economic changes to sustain momentum and navigate through any forthcoming uncertainty. But for now, construction leaders in Texas are likely most focused on their heavy workloads and busy schedules.

He has extensive experience advising on mergers, acquisitions, and divestitures. He has served as a Technical Reviewer for the American Institute of Certified Public Accountants’ (AICPA) construction audit and taxation guides for more than two decades and chaired the AICPA National Construction Program Conference Committee from 2012 to 2014.