Most small construction companies use the cash accounting method to record revenues when they are received. The cash accounting method can be advantageous in that it effectively defers income tax liabilities on amounts owed but not yet received by the business. It is also simple, straightforward, and can benefit the management of a business by keeping administrative costs low.

However, the cash accounting method does not facilitate sophisticated practices that might enable useful financial forecasting or paint an accurate picture of a business’s current financial standing. Construction firms can use the cash accounting method until they reach a threshold that requires a transition to the accrual accounting method.

The IRS requires that “large companies” — which it defines as those with average annual gross receipts of $30 million in 2024 and $31 million in 2025 — use the accrual accounting method. Certain projects and partnership opportunities, particularly those with licensing or bonding agencies, may also require the accrual method to be in use.

The accrual method of accounting is more complex, but also provides a more revealing presentation of a company’s actual financial standing. The accrual method affects taxation by calculating liabilities based on revenue earned, rather than cash payments received, at the time of filing.

The gross receipts test aggregates revenue across all related entities. Once your business meets the average gross annual receipts outlined above, you must use the accrual method to comply with Generally Accepted Accounting Principles (GAAP).

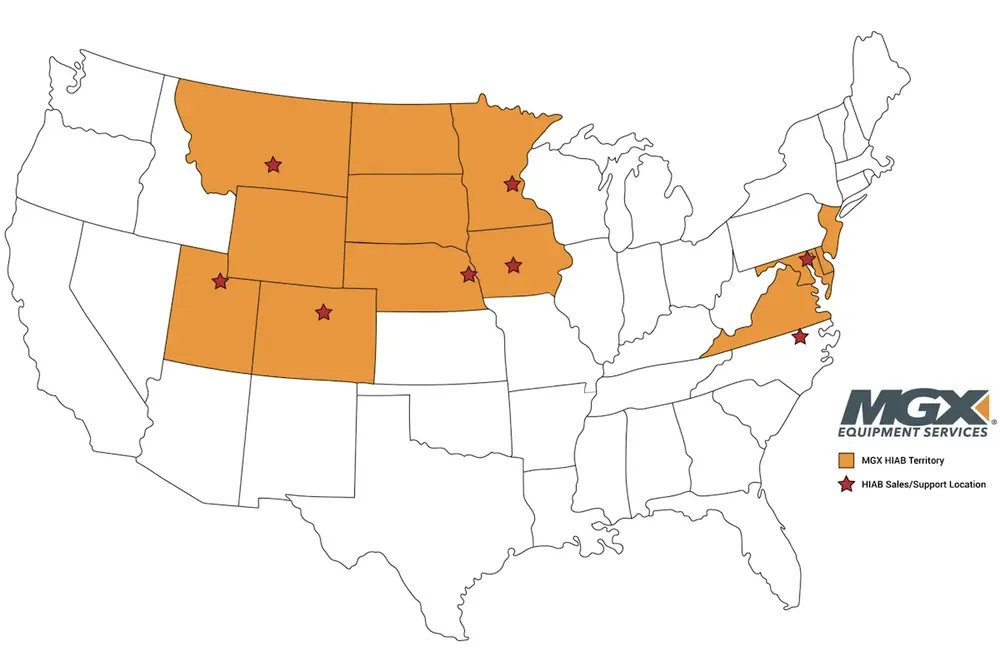

| Your local Trimble Construction Division dealer |

|---|

| SITECH Allegheny |

| SITECH Northeast |

Keep the following points in mind as you make the transition.

Filing

A Form 3115 must be filed to change accounting methods. Fill out parts 1, 2, and 4 of the 3115 and Schedule A, part 1, and Schedule B (if applicable). Note:

- No fee — The change from cash to accrual accounting is considered an automatic change, which means there is no user fee for submitting the form.

- Timing — To submit automatic changes, file the original 3115 with the return, and then file a signed copy of the 3115 with the IRS National Office no earlier than the first day of the year of change and no later than the date the original is filed with the return. Adjustment

- Favorable adjustment —it would generally be advisable to take the deduction all in the first year of the change.

- Unfavorable adjustment — it would generally be advisable to take the deduction over four tax years.

Calculate the net adjustment from the change of accounting, called the 481(a) adjustment. The adjustment is treated as a temporary difference in taxable income. If you have:

The transition from cash to accrual is more than a simple change in accounting methods. It is a sign of a company’s growth and increasing sophistication. There may be growing pains in making the change, but the result is a broader range of potential partners, investors, and lenders.

Those advantages may explain why some construction companies pursue the transition from cash to accruals well before they approach the revenue threshold. Still, retaining the cash accounting method for as long as possible is a viable strategy; just make sure you have a transition plan in place as revenue approaches the maximum amount allowed under the cash accounting method.