For contractors, the prebid conference is usually a familiar setting: a hotel conference room just off the interstate, rows of tables facing a projector, safety vests draped over chairs, and plan rolls stacked beside spec books. The job, like a new highway spur connecting directly to the interstate, is quite straightforward and fits squarely within the team’s capabilities. The department of transportation’s questions are standard, the bid window is reasonable, and conversations with agency staff go smoothly.

But when a project doubles in scope, as increasingly happens, the calculus changes. When the job expands, extra utility work, night shifts, and detours can severely stretch the design, risking lack of continuity and responsiveness to manage change without disruption.

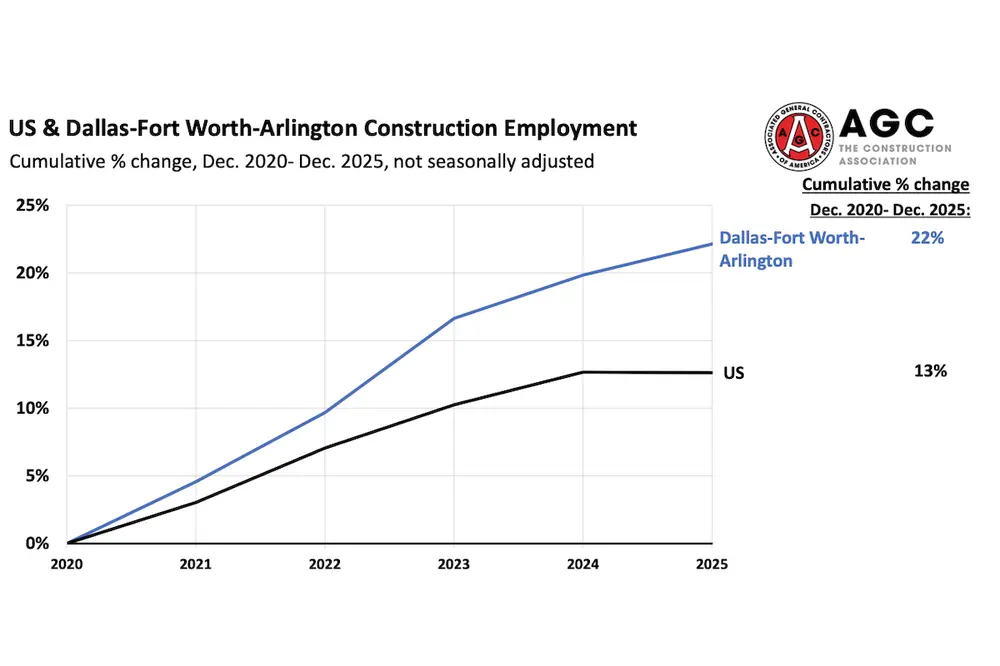

Industry pressures are making that circumstance more the rule than the exception. The Infrastructure Investment and Jobs Act unleashed a swell of transportation work, so scopes that once stayed tidy now balloon mid-project while schedules keep shrinking. At the same time, the sector is short on craft workers, leaving many design offices and field crews stretched thin.

In such a climate, general contractors can’t rely on hoping to get by; they need to verify that a design partner has both the bench depth and the balance sheet to keep pace when the job grows — as it inevitably will.

A slick slide deck can hide a wobbly balance sheet. You’ve heard the greatest hits: scalable design capacity, flexible staffing model, best-in-class quality management. Those phrases sound reassuring but often mask an A/E team’s deep structural issues. Before you sign onto a pursuit, here are the warning signs to watch for.

| Your local Trimble Construction Division dealer |

|---|

| SITECH Allegheny |

| SITECH Northeast |

The biggest red flag is heavy debt at the parent company. When 70 or 80 cents of every dollar of free cash flow goes toward servicing loans, hiring slows, technology investment stalls, and cracks start to show — first in staffing, then in delivery. But you won’t find this in a proposal slide. Getting a clear picture takes some digging: ask about recent recapitalizations, changes in ownership structure, or credit facility expansions. If the firm recently brought in outside capital to pay down debt and fund growth, that’s a good sign. If they’re evasive or can’t name where investment is going, proceed with caution.

High staff turnover is another warning sign. Even the best playbook falls apart if the personnel executing it keep changing. When project managers cycle out mid-job, knowledge gaps open up, response times slow, and accountability blurs. Continuity matters. If a design firm can’t show that key staff have stayed put across recent projects, that instability is likely to show up on your job, too.

Process is the most easily dressed up, and the hardest to verify. Firms love to show polished flowcharts with arrows for every RFI, submittal, and change order, often labeled “typical response: 48 hours.” But ask for proof and many can’t (or won’t) point to actual timelines from recent jobs. When a change order hits mid-construction, how long did it take to get a stamped revision? When a field conflict popped up, who escalated it and how fast was it resolved?

Then there’s the “one-deep” subconsultant: the firm that lists a single specialist for a critical scope, with no clear backup. Maybe it’s the drainage modeler, the signals lead, or the utility conflict coordinator. On paper, they look qualified. But if workload spikes or that person walks away mid-project, there’s no bench behind them. You get stranded, scrambling for coverage while your schedule bleeds. Ask early: Who else in your shop can do this work if your point person burns out, gets reassigned, or leaves? If the answer is silence — or worse, “we’ll cross that bridge when we get there” — you’re already on thin ice. A firm worth dealing with should be able to show at least 15 percent buffer capacity in core disciplines like roadway, structures, and utilities.

| Your local Trimble Construction Division dealer |

|---|

| SITECH Allegheny |

| SITECH Northeast |

Once you pick a design partner, the next step is to make expectations enforceable. A good teaming agreement doesn’t just list names; it defines how the team will respond when the job gets messy.

Start with turnaround times. Don’t leave RFIs and change orders to goodwill or “industry standard.” Put it in writing: five business days for routine responses and 48 hours for safety-critical issues. Include language about cumulative delays and what happens if turnaround targets aren’t met.

Build in a staff continuity clause. If a key discipline lead is replaced, the firm must notify you and the substitute must be approved in writing. This keeps your project from becoming a training ground for someone else’s new hire.

Add an escalation protocol. You don’t want to go through three layers of polite emails when field work stalls. The contract should include a one-page escalation ladder, actual names and numbers, and a requirement that issues be acknowledged within 24 hours.

| Your local Trimble Construction Division dealer |

|---|

| SITECH Allegheny |

| SITECH Northeast |

And finally, clarify scope growth readiness. You can’t predict every detour or utility surprise, but you can ask for a staffing plan that shows how the firm will respond if the job balloons. If they can’t produce that plan before signing, don’t expect them to improvise under pressure.

It’s tempting to assume that size alone solves the risk. After all, big firms can staff fast, advertise national reach, and show a dozen logos on the last slide. But scale isn’t enough, not if it’s built on shaky capital, weak systems, or forced expansion into sectors the firm doesn’t really understand.

That’s where capital structure matters. When a design firm is carrying heavy debt from a recent buyout, it might be big but brittle. Growth slows, tools age out, and the firm starts pulling engineers off your job to win the next one. But when capital is applied smartly to fund systems, hire deeply, and expand carefully into new markets, it becomes a stabilizer. A recap done right can bring in patient investment, flatten the organizational chart, and give project managers room to actually deliver.

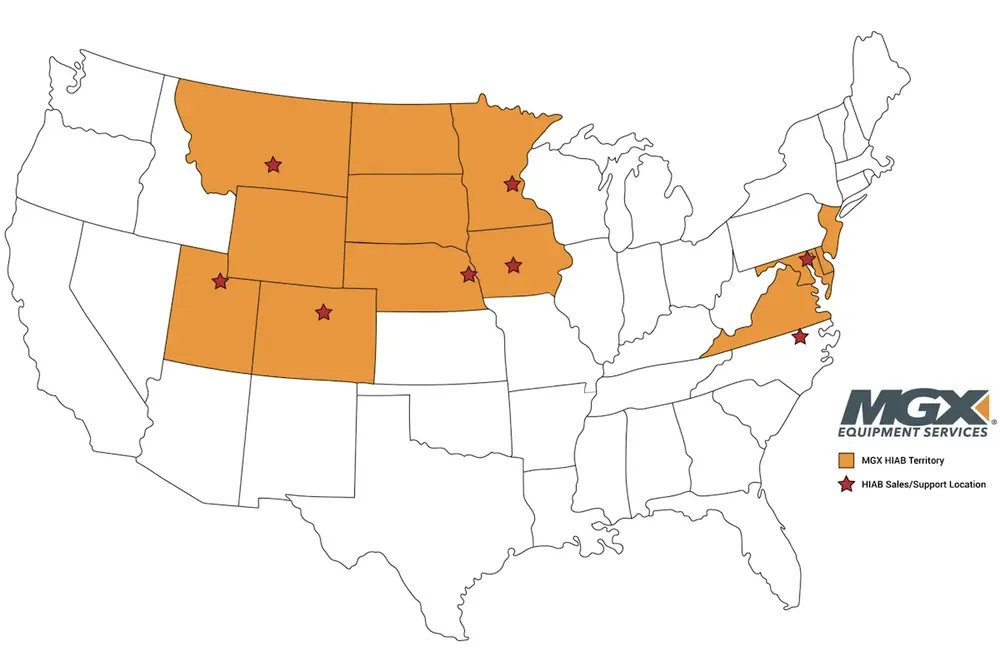

The challenge for general contractors is to be able to tell the difference. A firm chasing power work without a track record in grid codes or protection systems is a liability, no matter its size. The bid tab won’t show that risk — but your schedule will. The same goes for firms claiming multi-state presence but relying on phone-a-friend staffing to cover gaps.

| Your local Trimble Construction Division dealer |

|---|

| SITECH Allegheny |

| SITECH Northeast |

Don’t just ask: “Can you scale?” Instead ask: “Have you scaled on this type of job before? What were the bottlenecks?”

Charles Corpening is Managing Partner and Chief Investment Officer of West Lane Partners, a private equity firm focused on middle-market firms in infrastructure, industrials, healthcare, and financial services.