Much of those gains from 2022 to 2023 were driven by manufacturing, industrial, and data centers, which are a part of office spending. While the projection going forward is flat, it is holding at a high level. We aren’t expecting much growth in 2024, yet the high level of demand for construction will continue to accelerate challenges in delivering projects, particularly when it comes to labor issues and pricing.

For instance, manufacturing was not the largest construction segment in the U.S. a couple of years ago, but we saw approximately an 80 percent increase in manufacturing construction spending last year, which followed a 40 percent increase the year before. This is likely the strongest growth in manufacturing construction — or any segment — that I’ve seen in my 25-plus years of tracking these markets.

Similarly, when you look at other segments, you need to understand what’s below the surface or what is truly driving the total forecast for the entire segment. While office construction is flat — down 1 percent compounded annually — data centers, part of the office segment, are expected to see an increase of 50 percent in construction spending over the next several years.

You see similar nuances in other segments like commercial construction. Warehouses represented more than 50 percent of the commercial segment in 2021 and construction spending on warehouses increased 35 percent from 2019 to 2021, compared to a 15 percent decline in all other commercial buildings. In the education segment, K-12 construction is moving in a completely different direction than higher education.

| Your local Somero dealer |

|---|

| American Construction Supply |

| American Construction Supply |

This tension between segments that are growing and those that are contracting will be evident in the construction market in the next several years, making it imperative to understand exactly what is driving the forecasts so you can create successful strategic plans to take advantage of opportunities.

A lot of the growth we've experienced over the last seven to 10 years has come in the form of megaprojects, or those that are measured in terms of billions of dollars. There’s a concentration of these in various areas around the country, including what we see from a heavy civil perspective and in building projects.

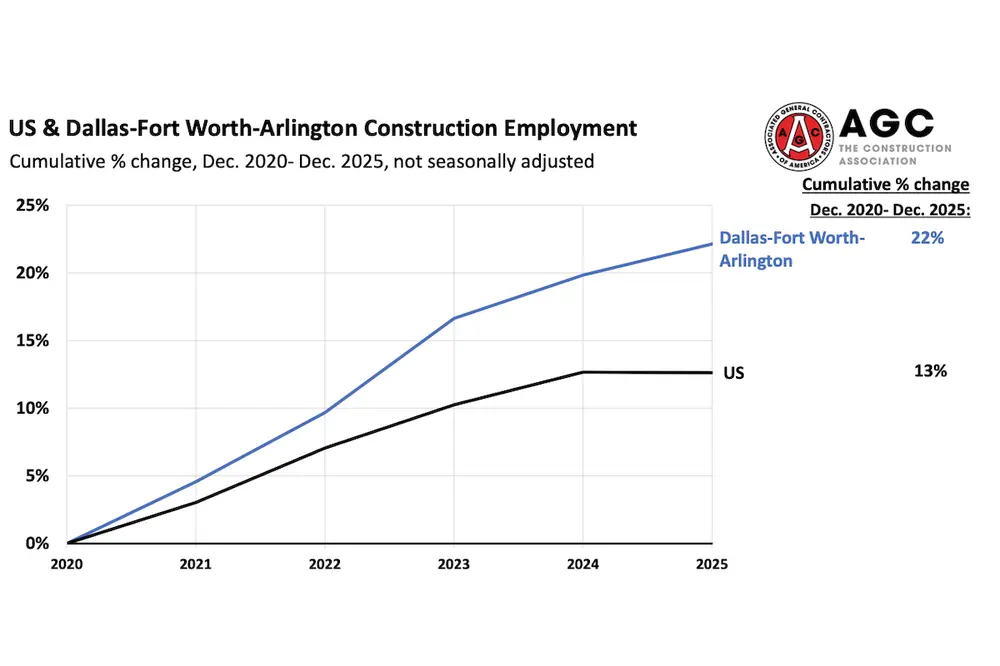

Even with the industry predicted to remain flat in terms of dollars put in place, these megaprojects tend to take up an outsized share of the labor force, materials, and other inputs in the markets where they’re being constructed. And they're not limited to their local place; often they pull resources from surrounding states. For example, Texas has a large concentration of megaprojects, and the effects of the resource demands are being felt as far away as Kansas, Missouri, and Mississippi.

Out of the 400 U.S. metropolitan markets, just 12 of those represent slightly more than one-third of all construction spending; about 35 percent of the $2 trillion in construction spending is in these 12 markets.

It’s been further concentrating over time. If I add the next 10 metropolitan markets, in those 22 markets we’re talking about 50 percent of all construction spending — so a trillion dollars in construction spending is concentrated in just 22 of the roughly 400 metropolitan markets in the U.S.

Given this, it’s easy to see how bulls and bears coexist. The market in Austin, Texas, looks vastly different than that of Des Moines, Iowa. That’s why it’s so critical to have a detailed understanding of the geography and sectors where you operate. This detailed examination of the underpinnings of your markets can help you determine the appropriate strategies for operating and where you might find opportunities for expansion.

In fact, the analogy I would use is mountain climbing. People going up Mount Everest must stop at different base camps to become acclimated to that new elevation before continuing to move forward — but they do continue to move forward.

I think we’re in this sort of acclamation phase with rates. What the markets don’t like is change or uncertainty. But once rates stabilize, markets adapt to the new normal. When you go back to the 1980s, rates were at double digits but we talked about how great the ’80s were. Building and construction was going on. And there was construction before it was 0 percent as well. It's just a matter of getting to that level.

There is no return to normal. It’s just what it is now and where might it go.

Every year since 2020 — even in the lead-up to 2020 — there was always another big thing. As Jay [Bowman] shared, bulls and bears exist at all times. They coexist.

Today, many factors are impacting us: AI, climate change, geopolitical tension, inflationary pressures. The key is how do we navigate it? It’s not about going back to the way it was; it has to be about going forward. It’s about maintaining awareness of these dynamics while staying focused on what’s achievable. What can we control? Ask the right questions and be strategic about the early engagement of experts to mitigate risks. Stay curious.

I say this often to people starting out in the industry, and this is just as applicable to those of us who are making big decisions: Don't assume things are going to work the same way they did 10 years ago. What got us here won’t take us there.

For example, the nature of work continues to evolve. Despite the differences we can make in automation and the things we can eliminate from a process standpoint, it’s still a people business.

We’re impacted by this in so many ways. Expectations of the job site and the office continue to evolve. Sometimes we’ve got four or five generations working together, with the increasing digitalization of those generations as they get younger.

In addition, there are geopolitical tensions. We’re in an election year, and it’s going to be tough for people. There’s no way the next eight months or nine months are not going to be difficult — and thereafter, as we saw in 2020.

I’m looking at 2024 as a hold on to your hat kind of year. But we can navigate it. You just have to stay alert, stay vigilant, and stay curious.

Editor’s Note: Excerpted from Skanska USA Building’s “Construction Market Trends” webinar presented on February 27, 2024.