As the U.S. shut down its economy in response to the outbreak of COVID-19, the Federal Reserve (Fed) quickly lowered rates to zero, supported parts of the capital markets to maintain the flow of credit, and directly invested in markets as it quickly grew its balance sheet. It was a similar response, but of even greater magnitude, to the financial crisis in 2008-2009. However, unlike their lack of action during that financial crisis, Congress responded actively to the pandemic and began a series of fiscal policy supports, which eventually totaled between $5 trillion and $6 trillion.

As the economy reopened, we saw a spike in inflation as demand began to exceed the output capacity of an economy still hobbled by pandemic policies. In response, the Fed raised interest rates and started shrinking the size of its balance sheet.

These actions led many economists (us included) to anticipate a weaker economy with the risk of higher unemployment. However, the federal government did not pull back on spending.

While we have not had additional fiscal stimulus "plans" since early in President Biden's term, the federal budget deficit has widened over the last couple of years to some $1.7 trillion in the 2023 fiscal year. According to the Congressional Budget Office, the forecast is for continued trillion-dollar-plus deficits going forward. Meanwhile, the economy continues to grow, and unemployment remains below 4 percent.

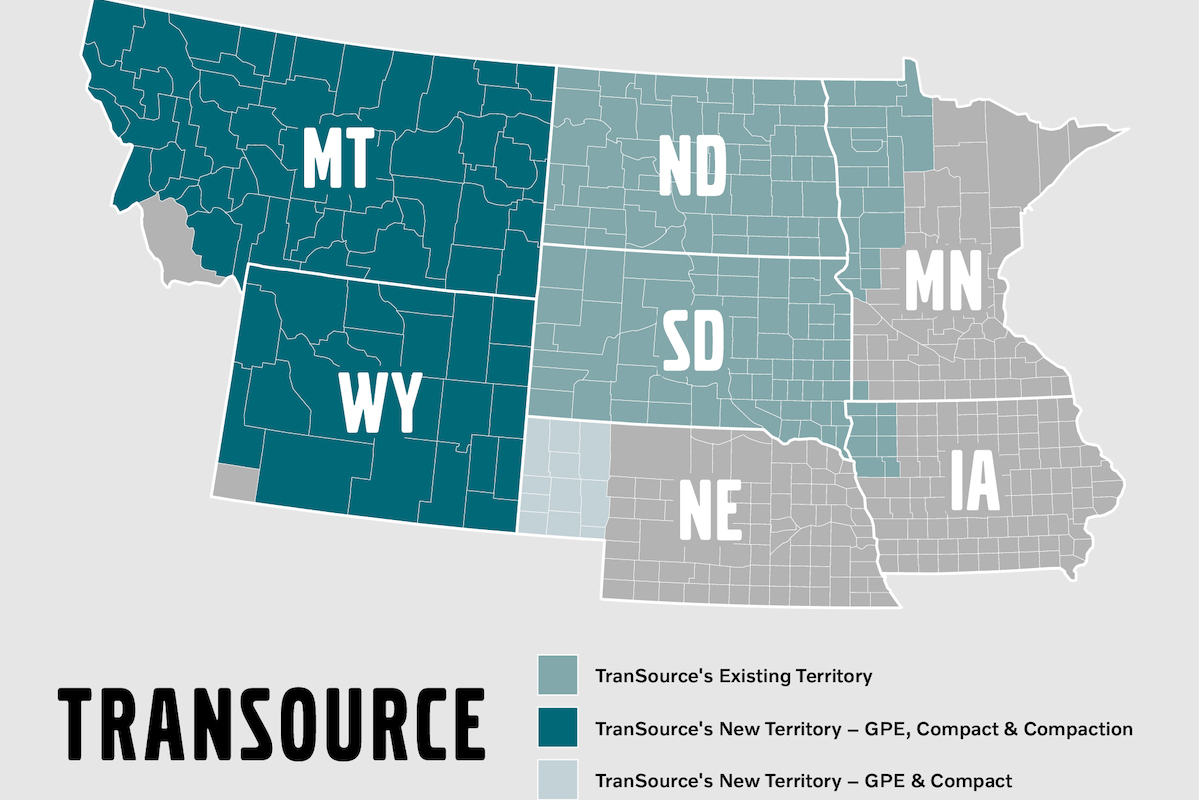

| Your local Volvo Construction Equipment dealer |

|---|

| Faris Machinery |

Despite the ongoing fiscal spending, we have seen inflation decline rapidly over the last 12 months — enough that we are expecting the Fed's next move to lower rates. Some economists and politicians are even asking why they haven't lowered rates sooner. After all, high rates are painful for personal and business borrowers.

Meanwhile, the current federal funds rate target range is well above recent readings on inflation, from the Consumer Price Index to the Producer Price Index to the Fed’s favored inflation gauge, the Personal Consumption Expenditures Price Index (PCE). Those calling for lower rates are, rightfully, pointing out that a stable Fed means real rates are going higher, which could increase the chances of slowing the economy too much over the next few months.

Studies of past inflation episodes have concluded that lowering rates too soon contributed to a second wave beginning, causing the Fed to raise rates even higher to slow the more stubborn second round of inflation. And so, while the current Fed’s patience may seem unnecessary from a short-term perspective, we should note that the right side of the “Inflation Waves” chart covers a much longer period than what we have been through so far.

As compared to the December dot plot, the variations within the outlook for 2024 have narrowed. However, looking at 2025 and 2026 shows how hard it is to make forecasts.

Consider that these are all members of the FOMC. All are highly educated and possess the latest and best information. Yet the dispersion of estimates is very wide, ranging from virtually unchanged for one dot to a target of 2.5 percent for another in 2025. This reflects a big difference in the outlook for the economy and inflation amongst the committee members. Those with higher rate estimates might think inflation is a bit stickier and/or economic growth will remain firm. At the same time, those with lower rate estimates might believe that the economy will weaken, allowing inflation to fall faster.

The dot plot may be most helpful as we consider 2024 and then the longer term. Why? While even short-term forecasting is hard, it is easier than 24 to 36 months out. When we think about the longer term, we can remove the cyclicality of the economy and just think about a longer-term average.

Based on the dots in 2024, the central tendency shows a consensus for three rate cuts, which matches the central tendency of the dots in the December 2023 SEP. However, the Fed’s forecast for growth in 2024 is a bit higher than in December, and the forecast for inflation is also a bit higher. This led some economists to wonder if the Fed might not be a bit more tolerant of inflation staying above their 2 percent target for longer.

While Fed Chair Jerome Powell initially disagreed with this assessment, it seems the Fed feels they are currently restrictive enough not to worry about slightly warmer inflation readings. More data could change that tune, but the Fed wants to begin lowering interest rates. Well-behaved inflation could warrant this, and the next rate move is lower, but one could find members of the FOMC who say otherwise. Why might that be?

So, what did the PCE report released in March 2024 show us? The headline number, which includes all items of personal consumption expenditures, was up 0.3 percent versus an estimated 0.4 percent. That looks good until we see that January's number was revised up 0.4 percent from an initial release of up 0.3 percent. And so, all in all, we can call headline inflation a wash and as expected.

On a year-over-year basis, headline PCE is up 2.5 percent. On the more important core reading, we saw an increase of 0.3 percent, as expected. However, like the headline number, January's release was revised higher to 0.5 percent from 0.4 percent. That’s maybe a skosh higher than expected, although year-over-year was as anticipated at 2.8 percent. Overall, nothing in these numbers should materially impact the Fed's outlook.

You may have heard the Fed describe a measure they deemed "super-core" some months ago. Since wages are not measured directly in the inflation data, they look at the "core services excluding housing" as a proxy since wages are the biggest part of the cost structure in that sector. We also look at housing, as it has been a key part of keeping the core inflation readings above the headline for the last few months. The March PCE report showed housing and rents improving but still well above the Fed’s target.

The third data point is “core goods.” Going back to before the pandemic reveals significant changes in inflation across different sectors. We know spending on core goods exploded during the pandemic, leading to significantly higher prices. Then, as the economy reopened and supply chains healed, we see core goods back to a disinflationary environment like the pre-pandemic period.

What has yet to recover are the more secular parts of inflation such as housing and core services. The trends in both continue to improve, but the absolute levels remain above the Fed's target and above pre-pandemic levels. It would seem the easy declines in inflation are behind us; it gets harder from here.

Engineering a so-called “soft landing” seemed like a low-probability outcome 12 months ago. As it stands, we are on the doorstep of doing just that. If the Fed can successfully navigate the next few months, it will be a huge win for our economy, consumers, and the markets.