Hundreds of industries rely on work trucks to connect with their customers. Commercial vehicles are used by retailers to deliver goods, utilities to maintain power lines, construction firms to haul materials, farmers to transport food to distributors, craftspeople at building sites to provide power and tool storage, local governments to plow snow, and more.

Trucks are an important part of the North American transportation system. They pick up from and deliver to shipping ports, airports and train yards, and carry other goods to companies in all economic sectors. Ships and trains transport more in terms of volume, but by revenue, trucks account for 75 percent of the total. The U.S. economy could not function without these vehicles.

The work truck industry is anticipated to generate about $150 billion of revenue in 2021. This is the expected sales value of truck chassis; complete vehicles such as buses, road tractors and Class 1–3 vans; truck bodies; and truck equipment. It breaks down to about 450,000 Class 2–8 work trucks, 250,000 road tractors, and 300,000 Class 1–3 vans sold this year. There are roughly 25 million work trucks/tractors/buses currently on the road in the U.S. Installed on these vehicles are toolboxes, hoists, snowplows, cranes, aerial lifts, air compressors, liftgates, generators, and many other types of equipment.

After a challenging 2020 – as experienced by most other industries in the North American economy – the work truck industry is strong in 2021, and sales through April are well ahead of forecast. But as typically occurs in any business cycle expansion, not all industry segments are growing at the same rate. As of May, data from NTEA’s OEM Monthly Statistics Program indicated Class 2–3 and Class 6 commercial truck chassis sales are increasing much faster than other market segments in 2021. Class 5 and 8 sales are also growing as of April. Sales of Class 4 and 7 chassis were lagging the rest of the industry.

| Your local Bobcat dealer |

|---|

| Ditch Witch West |

| Faris Machinery |

Through the end of this year, component shortages will likely continue to negatively impact truck chassis production and shipments. Delivery lead times are stretched for most cab-type/weight class market segments, but this is expected to improve (segment by segment) through the fourth quarter.

Labor market imbalances could remain an issue through 2022, and possibly longer. A truck driver shortage is contributing to delayed movement of goods to and from ports. In addition, manufacturers and distributors are reporting challenges in hiring skilled and unskilled labor. Note, this isn’t limited to the commercial vehicle market – almost all industries are being challenged to some extent by the worker shortage.

Commodities price jumps are creating additional complications for work truck industry companies. Metals prices began spiking in fourth-quarter 2020. In aluminum products markets, the rate of increase is no longer accelerating, but prices aren’t expected to peak until later this year. On a quarter-to-quarter basis, prices rose 25 percent in the first quarter alone. Steel sheet and strip prices started climbing after aluminum, and the rate of growth was still accelerating as of the first quarter. The price of some steel products more than doubled between fourth-quarter 2020 and first-quarter 2021.

From a truck fleet perspective, fuel prices are of greater concern. As oil increased from roughly $40 per barrel at the end of 2020 to about $70 per barrel by the first week of June, diesel and gasoline prices both rose to more than $3 per gallon. They’re expected to continue rising through at least the third quarter.

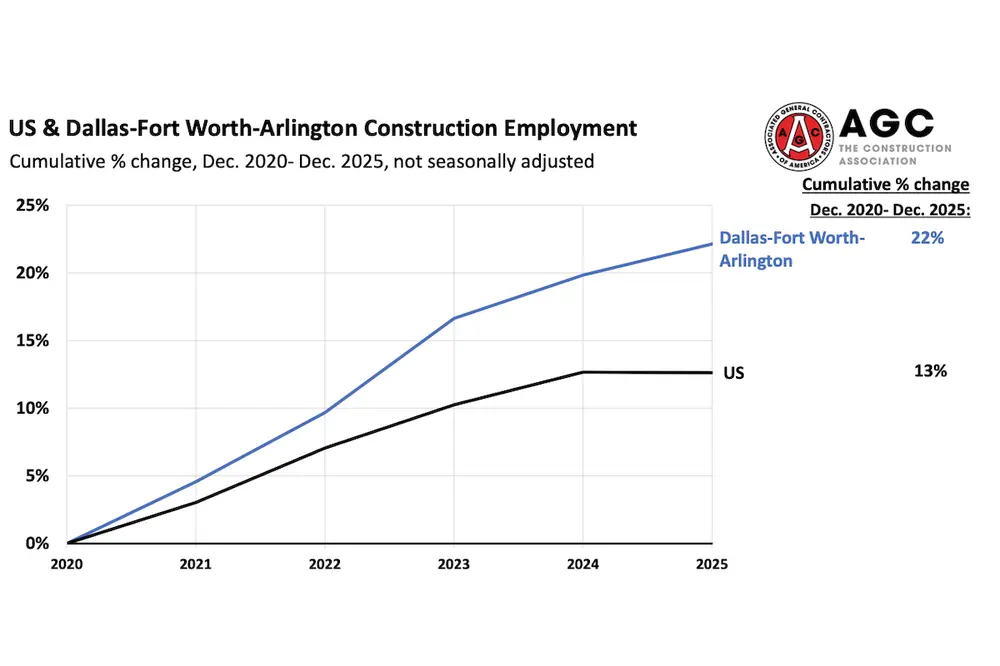

Despite these challenges, work truck industry sales grew about 22 percent through April 2021 – a historically high annual growth rate. This may be partially attributed to sales being low in March and April 2020. However, in unit terms, sales reached about 142,000 as of April – just 3 percent behind the first four months of 2019, which was a good year.

| Your local Gomaco dealer |

|---|

| Faris Machinery |

The 2021 forecast (published in December 2020) called for roughly 10 percent sales growth. When this estimate is updated in July, it will likely be revised upward. Annual comparisons will become more difficult in the second half of this year, but work truck and truck equipment sales are currently expected to end the year up 15 to 20 percent as compared to 2020, and sales growth through 2022 is predicted.