Rooted in the intricate web of property laws and the economic realities of urban development, these structures exemplify innovation in architectural adaptation and efficient land utilization.

Zakkyo buildings, also known as "leasehold properties" or "leasehold apartments," are a unique phenomenon in the Japanese real estate landscape. The term "zakkyo" originates from the Japanese words "zakkan" (lease) and "kyo" (apartment) and refers to properties where the land is owned by a different entity than the building itself. These buildings are prevalent in urban areas like Tokyo, where land prices are exceptionally high.

I want to discuss how places like Indianapolis with a plethora of vacant office space could take a cue from these types of buildings and how designers and planners got us here – and how we can get out.

Indianapolis already has several examples of the dynamic reprogramming inherent on zakkyo, namely The Stutz and Circle City Industrial Complex. Both examples involve a former industrial space that was converted into various uses – art galleries next to wineries next to coffee shops next to architecture offices.

Cities across the United States have done this to an extent – turning inner city industrial warehouses into residential lofts. The zakkyo takes this concept and applies it to office buildings, which offer their own challenges through a design and programmatic lens while maximizing the use of space in the core of commercial business districts.

The diversification of tenants involves less risk, as it does not put all eggs into one basket. In a macrocosm of this argument, the economies of Gary, IN and Detroit, MI were tied to the successes and eventual failures of manufacturing – a lack of economic diversification is a pitfall when long-term economic cycles are involved. You would not want to invest your financial retirement portfolio into just one industry, so why have a long-term investment such as a building fall prey to similar concerns?

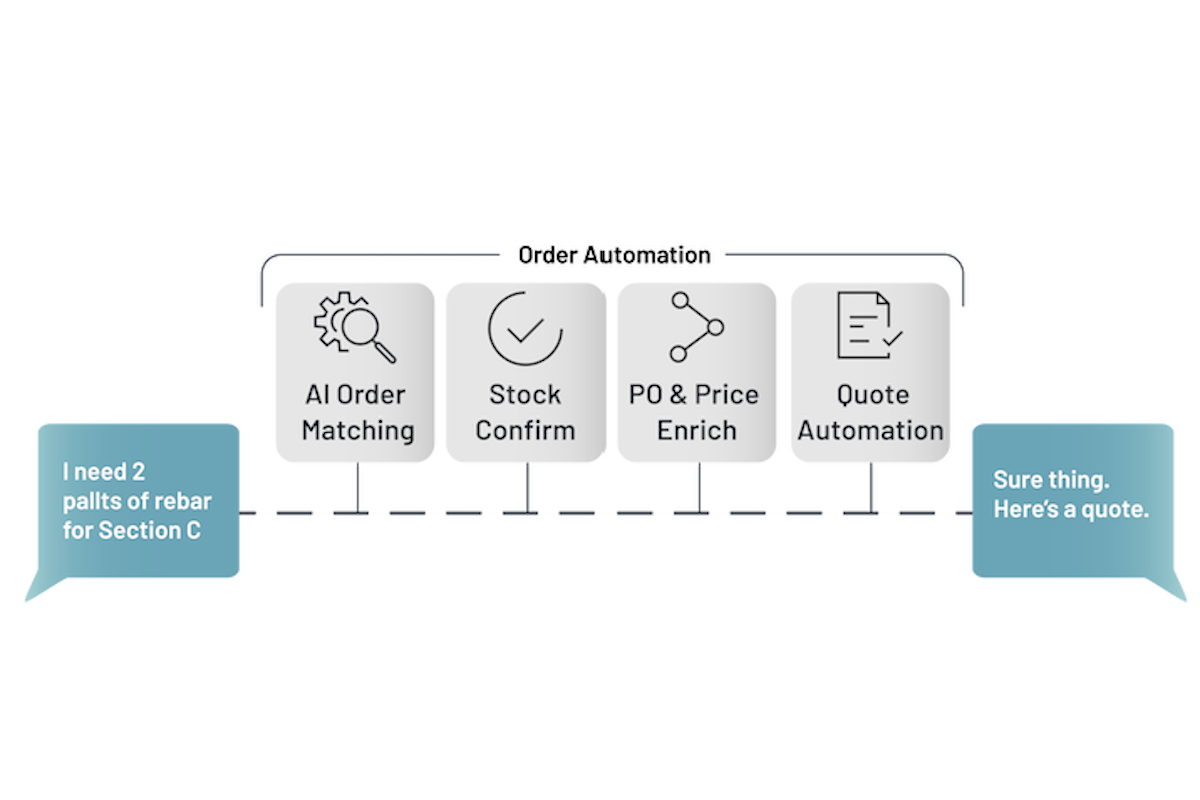

Most of Japan’s zakkyo buildings did not start at such, but rather began like many of the large office towers we see in downtown cities today; generic construction designed to fit large-scale office tenants, sometimes with a commercial ground floor. Over time, these buildings became zakkyo through a gradual vertical integration of uses through ownership bifurcating from building to floor. Staircases and elevators became an extension of the public realm and developed their own signage and advertisements for businesses within. This diversity of uses changes the possibilities of urban development.

However, we crave the weird! Big, hegemonic corporatism that disallows risk of use prevents the weird, esoteric, novel, and visceral nature of dynamic places in lieu of what investors perceive as ensured returns. We get a Chase bank instead of a pop-up market. Or, more commonly, we insist on vacant retail storefronts because the rent per square foot does not afford flexibility away from market figures used to justify the development in the first place. Large-scale “luxury” megaprojects require tremendous leveraged capital – investors are not going to want to see a 5-over-1 rented to an unknown local pop-up in lieu of a Panera Bread.

When this happens, our cities begin to look the same, and I argue this is not the architecture or aesthetic of gentrification but rather that of corporatism. The mistakes of mid-century planners (see, Interstates; See, Urban Renewal; See, Redlining) and the subsequent confrontation with the failures of those policies meant that new planners couldn’t or shouldn’t do top-down planning again. Thus, it was left to neoliberalism and free markets to do it instead. This results in the Hudson Yards era we are in now, the megaproject era.

This trend is typified by the facsimile of dynamic urban places I call aesthetic corporatism. These are your 5-over-1s, your “the Yards” type projects. They are usually master planned with one developer in conjunction with city subsidies and look to bring an experiential angle to development using key words like “mixed-use,” “urban,” “lifestyle center,” or some combination of “live-work-play”.

I’m guilty. I’ve planned these things. Not that there is anything wrong with trying to add density, housing, or job centers – but the master planning of new buildings adhering to a commonality of privately owned space gets a lot of things wrong on a human level — the level of giving places soul.

Again, we crave the weird! Zakkyo buildings can help restore the vitality of place by encouraging diversification and de-corporatizing space.

Large office towers in Indy could take note. Both the horizontal and vertical planes of the building become of interest to the resident and visitor alike, crafting a dynamic urban experience that promises return trips. This is already much in line with Indy’s reputation as a hospitality city. Why not entice visitors to come back?

Effective city building requires a continuing set of small, good decisions that stack atop each other – allowing better results incrementally. The Strong Towns movement gets this right to a point – what is the smallest thing you can do right now to improve your block, your place? Go and do that. That’s directly on the nose – we like to be valued, and to feel valued. We are attracted to places that look cared for and are thus worth caring for because they provide value to us. When we fail to actively care for our spaces, we initiate the vicious cycles that lead some cities into the disinvestment eras they are only now beginning to recover from.

Taking small actions generates larger positive outcomes. Small wins beget bigger wins. Allow small losses, and we reap the longer-term bigger losses that come from fear of place. How do we make sure our space looks cared for? Allow and invest in people to care for it. This leads to better places because everyone wants to invest in what’s being invested in. No one wants to invest in what’s not.

But allowing small wins means permitting small starts. Zakkyo buildings help to imbue the “eyes on the street” model while allowing the democratization of retail that encourages an entrepreneurial spirit. Imagine why a place like Midland Antiques Market on the Eastside is successful – it allows one to pursue, be intrigued, and find interest. To see and be seen in the commons of the market. Zakkyo buildings could be just that, but imagine a 20-story building filled with flea markets, attorneys offices next to karaoke bars next to hair salons. Imagine small leasable commercial spaces of less than 500 square feet that a young person or entrepreneurial immigrant could afford.

Architecturally, this arrangement necessitates a flexible and efficient use of space. Designers must maximize the utility of the building footprint while accommodating the transient nature of the building's tenure. This often results in sleek, compact designs that prioritize functionality without sacrificing aesthetics. Internally, zakkyo buildings are masterpieces of spatial optimization. Compact floor plans are carefully curated to maximize livable space while offering essential amenities. Flexible layouts cater to the diverse needs of residents, from single professionals to growing families, ensuring that every square meter is utilized efficiently.

Yet, beyond their architectural ingenuity, zakkyo buildings embody broader socio-economic trends. As urban populations continue to grow and land becomes scarcer, these structures offer a viable solution to the perennial challenge of affordable housing. By decoupling land ownership from building occupancy, zakkyo buildings provide a pathway to urban living for a diverse range of residents.

In an era defined by rapid urbanization and shifting demographics, zakkyo buildings stand as a testament to the adaptive capacity of architectural innovation. Through their efficient use of space, flexible design principles, and innovative ownership models, these structures redefine the urban landscape, offering a glimpse into the future of sustainable, accessible housing. With our glut of vacant office space in downtown Indianapolis, commercial real estate lenders and property owners should take note of other ways to fill their spaces – and think about the idea of a vertical city, teeming with diversity of use, engaged architecture, and active programming all day long that creates destination, and with it, investment potential.

Jeffery Tompkins, AICP, is a city planner and a resident of the Near Eastside of Indianapolis.