FMI Corp’s fourth quarter Heavy Civil Index report forecast a less than 1% increase* in heavy civil construction put in place for the U.S. for 2022.

As of the fourth quarter, FMI forecast an 8% increase in total U.S. construction put in place for 2022, but that is expected to contract to -1% in 2023 as the economy weakens.

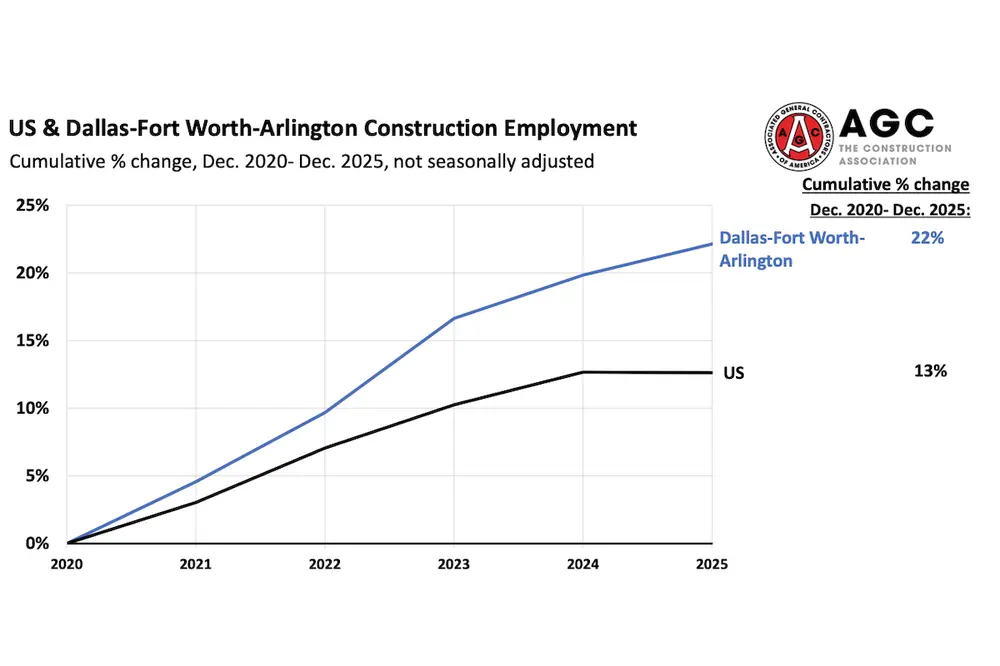

“Contractors can expect many market changes in 2023,” says Ken Simonson, Chief Economist for the Associated General Contractors of America. “Single-family homebuilding is likely to shrink substantially, at least in the first half of the year. Income-producing properties such as warehouse, retail, office and hotel construction are vulnerable to a squeeze between rising construction and financing costs versus flattening rental rates. On the positive side, there are likely to be large increases in infrastructure, manufacturing and power-related construction along with continuing high levels of investment in data centers.”

Tate Johnson, President of Yanmar Compact Equipment North America, agrees. “At this time nonresidential construction is still on-pace for a 9% increase for 2022; and another 5% is forecast for 2023. That is not across all categories, with office and retail remaining weak and warehousing and transportation continuing to grow. The highway/infrastructure side of the economy continues to grow as well with growth from 2021 infrastructure legislation delayed by a lack of labor.”

| Your local Bobcat dealer |

|---|

| Ditch Witch West |

| Faris Machinery |

On the infrastructure side, FMI’s forecast expects expanding opportunities tied to the IIJA and IRA funding measures to drive infrastructure spending through 2026, with the largest increase occurring in 2025. Most segments will see double-digit growth, except for power infrastructure, which will lag over the next two years.

Expectations for the overall U.S. economy and local economies where respondents conduct business improved but remain mostly pessimistic. Additionally, optimism softened considering the outlook for respondent’s engineering and construction businesses and the markets where they participate.

Survey participants anticipate improving opportunities in most segments, apart from commercial and residential site development. Optimism improved for transit and rail and regressed somewhat across highway and bridge, aviation, public utilities and other civil infrastructure.

The backlog book-to-burn rate indicates that fewer respondents this quarter were able to add backlog relative to the rate at which it is being burned off (39% this quarter versus 46% last quarter). Similarly, fewer respondents reported that backlogs are higher than one year ago (53% versus 64%), and an increased share of respondents indicated that backlogs are below targets (29% versus 25%). Backlogs remain an increasing concern for the end of 2022, with a large portion of respondents suggesting slowed growth in project wins or missed goals.

Compared to the third quarter of 2022, respondents reported improved margins on both a year-over-year (42% versus 36%) and quarter-over-quarter (36% versus 28%) basis. Likewise, competition is seen increasing (33% versus 20%), and bid prices have pulled back (18% versus 10%). Furthermore, nontraditional firms continue to dip into the heavy civil arena, with about 1 in 5 companies continuing to find these new entrants in their markets.

The above chart shows the Bureau of Labor Statistics (BLS) Producer Price Index (PPI) for inputs into highway and street construction. This measure captures the national average weighted cost of material, energy and service inputs to the industry. It excludes the cost of labor, capital and imports, as well as other inputs such as overhead.

| Your local Gomaco dealer |

|---|

| Faris Machinery |

PPI was up 11% year-over-year in November and 35% over the last two years. To put this into perspective, the average annual increase was 2.4% in the preceding five years. One positive indication that supply chain issues are easing is that the PPI is down 2.5% since May.

The takeaway here is that while cost increases for many inputs remain elevated above historical levels, there has been easing over the last six months. Ready-mix concrete is the only included commodity for which cost increases were higher in the most recent six-month period.

Note there could be some seasonal factors that are material to the comparisons made in the last chart, but the PPI data overall is pointing to a moderation over the last half year. The rapid increase in interest rates over this period is likely a key driver, as well as an easing of domestic supply chain issues.

“Along with changing demand for project types there will be continuing pinch points for materials prices and supply,” Simonson says. “Cement and concrete shortages are likely to persist and perhaps even worsen. Long lead times for electrical gear and products that depend on semiconductor chips may not improve before late in 2023. But lumber and metals prices and availability are likely to be much less problematic than in 2020 and 2021.”

Contractors participating in FMI’s HCCI feel that conditions have somewhat improved related to material and labor costs, though both remain a drag on the overall sentiment index. Based on survey responses, improved availability and price stability for materials over the past quarter has helped many to catch up with or adjust to cost increases incurred earlier in the year.

| Your local Trimble Construction Division dealer |

|---|

| SITECH Southwest |

| SITECH Northwest |

| SITECH Rocky Mountain |

According to Robert Henderson, Executive Vice President and COO of the Associated Equipment Distributors, many of their members are seeing current equipment orders with delivery dates into 2024, reinforcing Simonson’s comments.

Johnson agrees, “It’s no secret that our industry continues to feel the impact of high inflation and prolonged supply chain disruption – with lead times longer than ideal in many areas.” However, despite risks associated with long lead times, demand is still there as retail remains strong and rental fleets need restocking, he notes.

According to a recent McKinsey & Company report, “If left unaddressed, several occupational-demand challenges could spur inflation. For instance, most construction companies are competing for the same talent. Welders, for example, will be required at scale for manufacturing in addition to their role in the construction process—meaning without cooperation, manufacturers will compete with contractors for the same limited set of welders.”

Simonson concurs, “Worker availability will be the biggest challenge for many contractors. With job openings in construction remaining near record highs, contractors will have to raise pay even more than in 2022 and invest more in labor-saving equipment, technology and methods.”

Advanced technologies can offer some relief from the labor shortage, but autonomous machines, robots and artificial intelligence are still far outside of many contractors’ budgets. Companies will need to revisit what employees want beyond wages to retain current staff and attract new employees. The construction industry should look at a broader range of individuals including those who have taken a nontraditional educational paths, veterans, formerly incarcerated individuals, minorities and women to fill vacancies.

Many factors will determine the extent of any recession including interest rates, which are expected to continue increasing through March topping off somewhere around 5.5%. If Congress engages in a protracted standoff over lifting the debt ceiling, it could create further downward pressure on the economy. The Russian-Ukraine war could have the effect of deepening a recession if Russia terminates oil exports to the West and Japan.

| Your local Volvo Construction Equipment dealer |

|---|

| Faris Machinery |

FMI anticipates the U.S. economy will fare better than most countries, as reflected by strong demand for labor and the long-term commitment to infrastructure investments. As a result, the engineering and construction industry is expected to play a major role in our economy’s foundational strength over the coming years, offering a combination of both challenges and opportunities.