Panelists who are directly connected to the economic viability of downtown shared their perspectives on the future of Indianapolis and offered insight into recovery strategies for the central business district.

Michael Huber, Indy Chamber President and CEO, served as moderator.

“It’s been an incredible rollercoaster this past year for Indianapolis, and we know there’s so much concern and energy, but also a renewed sense of optimisms about downtown,” Huber said. “We’re going to hear from expert panelists from different disciplines today about the future of downtown.”

Can you provide a past, present, and future snapshot of downtown Indy from each of your industry’s perspectives?

Patrick Tamm, CEO, Indiana Restaurant and Lodging Association

“The past present and future is all about resiliency and survival. Were far from being out of the woods,” Tamm said.

Lilly announced in early May that its employees would return to downtown offices, which Tamm said was big gust of wind in the sails of the restaurant industry.

Tamm reiterated that the survival of any downtown district is very bleak post-pandemic, but pointed to the recent NCAA Tournament and Indy 500 race as examples of Indianapolis’ renewed commitment to hosting events. “A lot of states aren’t even thinking about that; we’re doing it and have been for weeks.”

Matt Langfeldt, Executive Vice President and Co-Market Leader, Colliers

Langfeldt said his industry analyzes three noteworthy metrics when determining COVID-19’s effect on office space: Sublease space on the market, direct space on the market, and quoted rental rates.

From a sublease standpoint, downtown Indianapolis has less office space on the market now than it did two years ago at almost identical rates, which is a good sign.

Langfeldt said Indianapolis has seen a slight increase in direct space inventory during the past two years (16.5 percent in 2019 Q1 vs 19.5 percent Q1 2021). He added that much of the rise in direct vacancy can be attributed to a few major, pre-COVID transactions, so that increase is not just a result of the pandemic.

From an asking rent standpoint, Indianapolis was looking at an average rate of $25 per square foot in 2019 Q1. Today, that figure sits around $25.70 per square foot, marking an encouraging upward trajectory for rental rates.

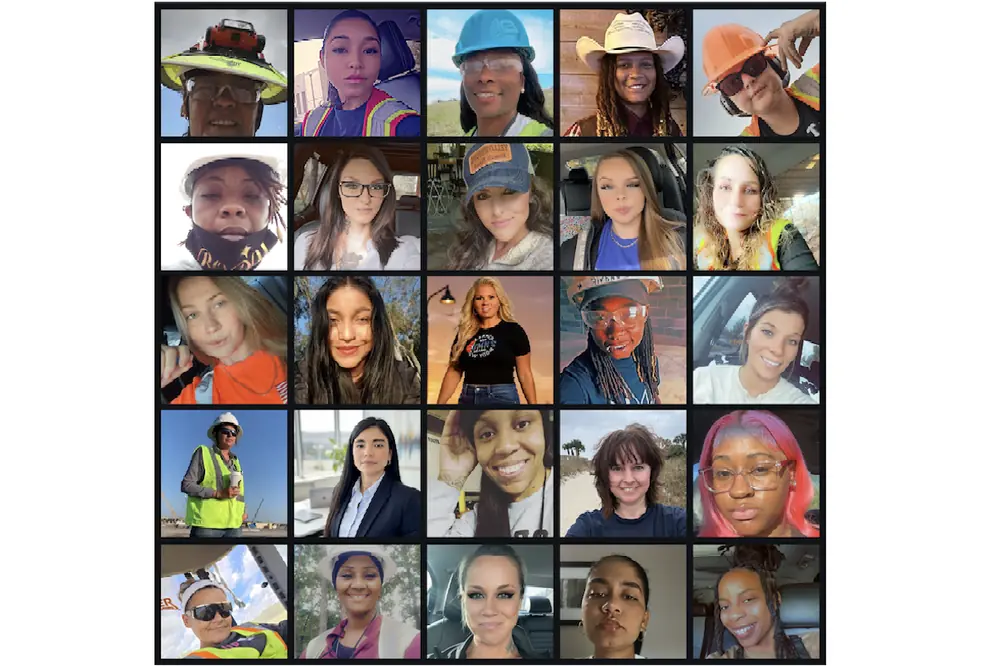

Sherry Seiwert, President, Downtown Indy, Inc.

In January of 2020, Seiwert recalled Indianapolis announcing new hotels discussing potential residential developments.

“Almost everything came to a screeching halt,” Seiwert said. “Two years ago, we completed 23 construction projects. This past year we only completed nine, with about $410 million worth of investment.”

Seiwert added, “Certainly, we’d love to see more construction and we’d love to see more developments financed and announced, but we really do need that workforce back downtown.”

Seiwert said many downtown employers anticipate a hybrid return to work after the Fourth of July holiday.

Portia Bailey-Bernard, Vice President of Economic Development, Develop Indy

From an economic development perspective, Bailey-Bernard said she anticipates more of a focus being put on placemaking.

“I think we’re going to have to focus more on the individual employee versus going after the larger companies to have their headquarters here.”

Bailey-Bernard said she thinks more employers will switch to hybrid working models after the pandemic and referenced 16 Tech as a prime example of a space designed to support post-pandemic working models.

“It’s about rethinking how we view incentives and putting more of an emphasis on placemaking by making the city more of a place that people not only want to work in, but actually want to live in,” Bailey-Bernard said. “Indianapolis is well-positioned with the cost of living and all it has to offer to build off of that.”

What were the most common questions you received from organizations about hosting events downtown prior to the pandemic and after?

Tamm

Now, it’s more safety questions, CDC issues, questions about what local health departments will allow and not allow.

Compared to other states, Indiana enjoys better working relationships between local and state health departments, Tamm said, which facilitates more opportunities for better conventions.

Siewert

“Before the pandemic, if you wanted to host event here, there were so many bookings that it would be difficult to find convention space or hotel space,” Seiwert said.

Now, like most downtowns in the country, Indianapolis is trying to get as much business as it can. Organizations ask more questions about the safety and feeling of the city than they did pre-pandemic, Seiwert said.

Bailey-Bernard

Pre-pandemic, Indianapolis had $1.4 billion in capital investment and over $728 million in redevelopment across Marion County in 2020.

Now, businesses are more concerned about the workforce and what the pipeline looks like. Bailey-Bernard said the city is looking at different ways to finance some projects by exploring various creative tools.

Langfeldt

Before COVID-19, Langfeldt said discussions about office space were centered mostly around amenities (i.e., what’s inside the building and what’s happening when you walk out the door).

“The highly amenitized experiences will perform well coming out of this and we’re already seeing that happen.”

Regions Tower, Salesforce Tower, Market Tower, OneAmerica Tower, others in downtown have already been repositioned to bring more talent into those buildings, Langfeldt said.

What is the biggest obstacle to reenergizing downtown?

Langfeldt

“For me, it’s just bodies; we need more people back down here,” Langfeldt said.

Lilly’s announcement that 25 percent of the company’s employees can return to offices mid-June and 100 percent by the end of July lines up with timelines Langfeldt is hearing from a lot of businesses thinking about coming back. He said conversations now versus a few months ago are much more positive and businesses are seeing the end of the tunnel.

Seiwert

“How do we make downtown more interesting than your living room?” Seiwert said of the number one obstacle facing downtown Indianapolis. “At what point do you say, ‘I want to get out of my house and go down there?’”

Vacant retail spaces are beginning to fill back up downtown in areas like Monument Circle and the Wholesale District, indicating that businesses are feeling more confident that people will return downtown in pre-pandemic numbers.

Bailey-Bernard

Bailey-Bernard echoed Seiwert, saying that the retail market returning to downtown districts is the number one questions facing downtown now. Bailey-Bernard said 30 local businesses are partnering with landlords around the city to activate a lot of those vacant spots and storefronts.

She said the City also saw success with some retail startups during March Madness that signed long term leases after the event.

Tamm

“Getting people into those central business districts is going to be absolutely critical,” Tamm said.

Sitting in on the stage of the Living Room Theatre, Tamm described Bottleworks as an international tourism destination. He said people travel for food, and multiple restaurants have signed leases at The Garage even in the last 6 to 8 weeks that will attract tourists from across the world.

Tamm described sales figures at The Garage, which just opened its doors in January of this year, to be “phenomenal, strong, exceptional” and said sales at The Garage far exceed numbers seen across most of the state and country during the past six months.

“No one else has opened something like this during the pandemic across the country,” Tamm said.

What can we do to incentivize new and existing quality of life assets like restaurants and theaters downtown?

Tamm

“Don’t expect to go back to what it was,” Tamm said. “It’s going to be different.”

Tamm said Indianapolis must determine how to best position itself to adjust to the new normal, which is done by producing quality of life assets like Bottleworks and creating unique neighborhoods. Lower taxes and property costs may not appeal to some people, so systems like transit-oriented development further incentivize potential residents.

Bailey-Bernard

“Indy has all the tools,” Bailey-Bernard said. “It’s just a matter of figuring out what those attractive places look like and how to use those tools post-COVID.”

Placemaking will be crucial moving forward, but Indianapolis already has the capacity for it with spaces like Bottleworks, 16 Tech, and the upcoming Elanco HQ, she added.