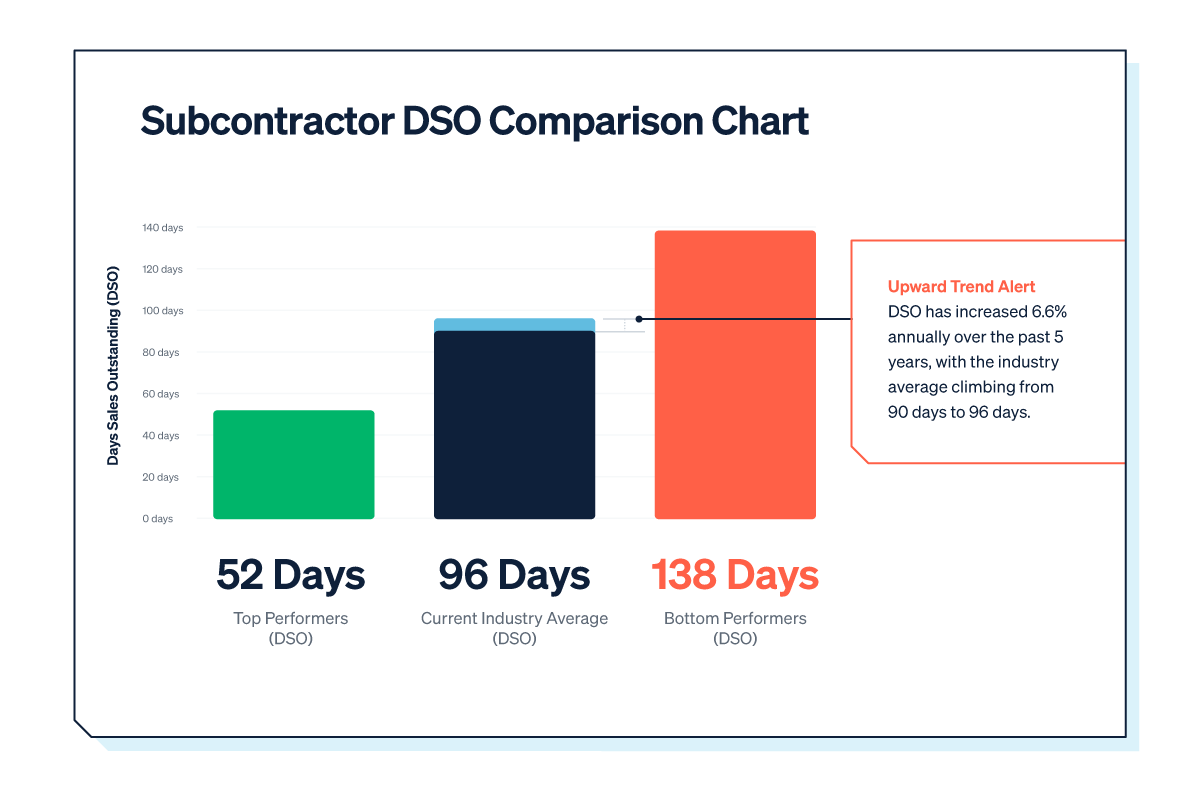

Slow payments have long been a fact of life in construction, but the latest data confirms what many subcontractors already feel in their bank accounts: things are getting worse, not better. According to Siteline’s State of Subcontractor Billing in 2025 report, subcontractors now wait an average of 96 days to get paid, up from 90 days in 2019. Other industry reports show that only a small percentage of subcontractors report always receiving payment on time, and a high percentage cover vendor costs out of pocket while they wait.

This isn’t just an inconvenience. Payment delays are fueling a working capital crisis that threatens the long-term sustainability of trade contractors across the country. In fact, the number of subcontractors relying on their retirement savings to stay afloat has jumped exponentially.

The costs extend far beyond individual companies. Payment delays are bleeding the industry of an estimated $280 billion annually. While general contractors also feel the pain of slow payments, subcontractors face the sharper edge of the crisis:

- Cash flow crunches — With payments averaging more than three months, subs are often forced to delay vendor payments, trim crews, or walk away from profitable projects simply because they lack the cash to take them on.

- Administrative overload — Every stalled or rejected pay application means more follow-up calls, resubmissions, and reconciliations. What should be time spent on projects instead gets consumed by chasing paperwork.

- Labor market strain — When payroll isn’t reliable, skilled workers move to industries with steadier pay cycles. The result is fewer qualified crews, longer project timelines, and even more pressure on cash flow.

- Rising project costs — To hedge against risk, contractors are padding bids by up to 10 percent to offset financing costs. The result? Everyone pays more, from owners to end users.

It’s no exaggeration to say the industry is leaving money on the table. Faster payments could cut 14 percent of construction costs, according to Siteline’s report. That’s nearly one out of every $7.

Almost every GC agrees that paying subs faster is better for business. Yet systemic process problems continue to gum up the works.

| Your local Case Construction Equipment Inc dealer |

|---|

| Beauregard Equipment |

| Monroe Tractor |

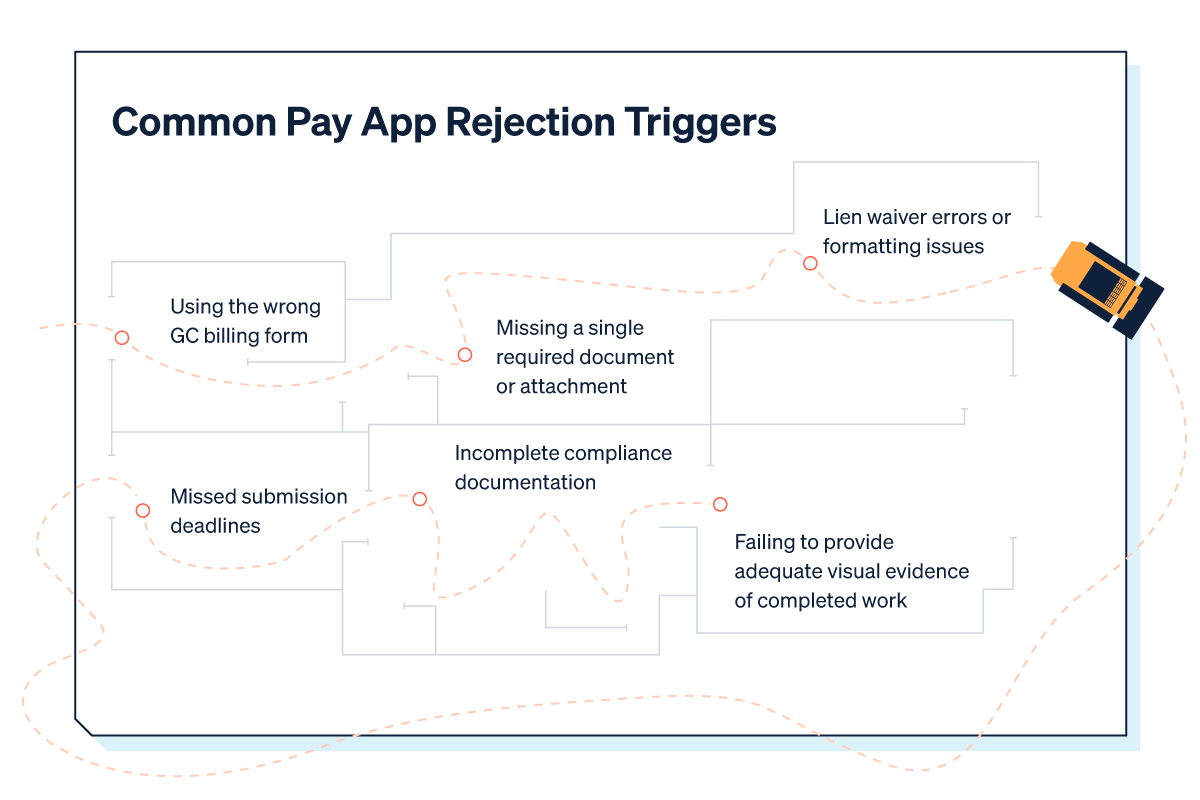

For subcontractors, the challenges are familiar:

- Missing a single lien waiver or insurance certificate

- Submitting on the wrong form — or on time but to the wrong portal

- A formatting error that triggers a rejection and restarts the clock

- A misplaced period during data entry that changes the amount and kicks the whole pay app back

When projects hinge on manual, error-prone billing workflows, delays are inevitable. Even the most diligent subcontractors can see payments slip simply because the process wasn’t designed with them in mind.

While systemic change requires coordination across the industry, subcontractors aren’t powerless. There are proven ways to shorten payment cycles and improve cash flow.

1. Strengthen Your Documentation Discipline

Rejections are often triggered by missing or expired attachments, like a single certificate of insurance or lien waiver. Simple checklists and internal deadlines can help ensure every pay app leaves your office complete.

| Your local Wirtgen America dealer |

|---|

| United Construction & Forestry |

| WI Clark |

2. Know Your GC’s Quirks

Every GC has its own billing forms, portals, and submission rules. Building quick internal cheat sheets for each GC’s requirements prevents last-minute scrambles and avoids rejections over formatting or portal errors.

3. Invoice as Early as Possible

Every project has a tight billing window, and missing it can mean waiting another month — or longer — to see payment. Submitting as soon as the window opens gives you more time to fix errors, catch missing attachments, and resolve GC questions before the deadline hits.

4. Improve Reporting and Visibility

Tracking key metrics like days sales outstanding (DSO), rejection reasons, and approval timelines gives you a clearer picture of payment performance across projects. Visibility into these patterns not only highlights bottlenecks but also strengthens your position in negotiations and helps you spot problem clients early.

5. Forecast Cash Flow with Data

Don’t just look backward at collections — use your billing data to project forward. Reliable forecasting helps anticipate shortfalls, plan payroll with more confidence, and make smarter decisions about which projects to pursue or pass on.

| Your local Hyundai dealer |

|---|

| Equipment East |

6. Leverage Technology Where It Counts

Even incremental improvements — like digitizing lien waiver collection or automating compliance tracking — reduce rejection points and save staff time. Over time, these changes compound into meaningful cash flow improvements.

The data shows that subcontractors who switch from spreadsheets and email-driven billing to automated platforms achieve real results. For example, Kovach Enclosure Systems, a family-owned contractor specializing in custom metal and glass enclosures, shaved 20 days off its average payment time and saved three days a month in billing preparation by digitizing its billing process.

The construction industry has tolerated slow payments for decades, but the 96-day average should be a wake-up call. If left unchecked, the cycle will continue to choke subcontractors’ cash flow, drive up project costs, and push skilled labor out of the industry.

The path forward is clear: Subcontractors who modernize their billing processes — whether by strengthening documentation practices, building GC-specific playbooks, or adopting digital billing tools — put themselves on a stronger footing. They not only improve their own financial resilience but also help stabilize the industry as a whole.

| Your local Trimble Construction Division dealer |

|---|

| SITECH Northeast |

Graphics courtesy of Siteline.

Claire Wilson is Co-Founder and Chief Operating Officer of Siteline, a billing software for subcontractors. Previously, she was a Project Manager at Tishman Construction in New York City, where she worked on major projects like Hudson Yards and JP Morgan's corporate headquarters.