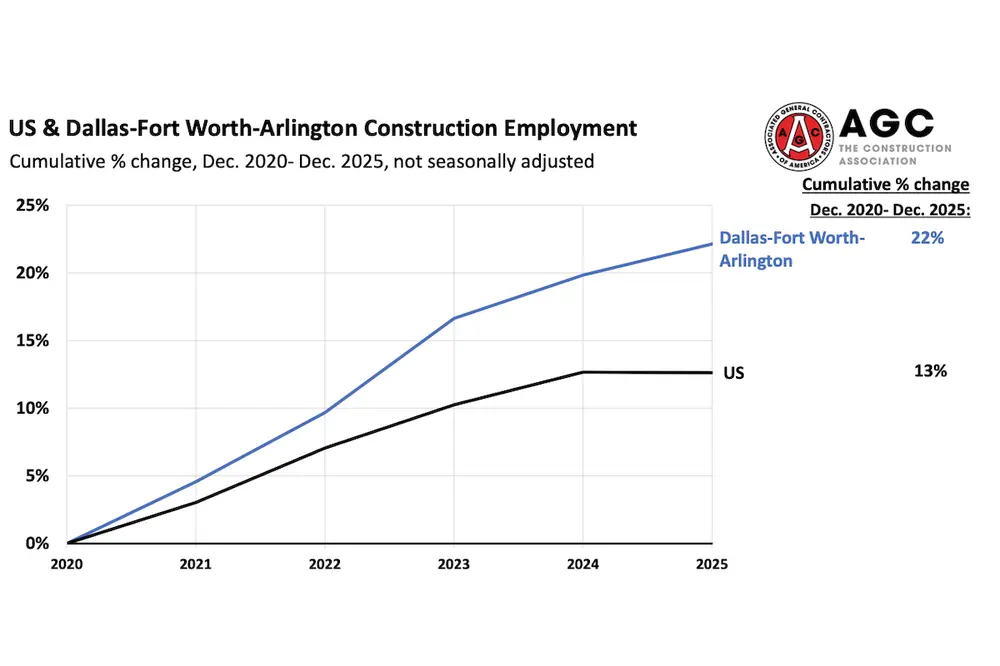

Today, the region's labor force is 2.5 percent larger than in February 2020. Since the early pandemic, the employment figures in the construction industry have grown by 7.6 percent. After many years of limited labor availability, open roles may be a little easier to fill. Unfortunately, the recent contraction in year-over-year hiring could suggest there isn’t enough work to sustain employment construction at this level.

Nationally, construction spending has experienced a slight dip, with a mere 1 percent increase over the full year. After factoring in inflation, this suggests a decline in real dollar investment. It is a potent example of the pressures bearing down on various construction market segments and could suggest that the trouble currently facing the Pacific region could soon reach other markets.

In Marcum’s most recent construction survey analyzing Q4 of 2023, the Commercial Construction Index, Marcum Chief Construction Economist Anirban Basu suggested that price escalations have leveled off to offer some relief, particularly in the later parts of the year. Yet, despite these tailwinds, including global supply chain improvements and a reduction in global demand, commodity prices persist at levels approximately 38 percent higher than those seen at the pandemic's outset.

While all eyes remain fixed on the Federal Reserve's monetary policies, the future hinges on more than FED action. Marcum’s survey of the industry reveals that its leaders feel the need to stay alert and flexible in response to economic changes to sustain momentum and navigate through any forthcoming uncertainty.

| Your local Somero dealer |

|---|

| American Construction Supply |

| American Construction Supply |

In the region, the construction industry stands at a precipice marked by a concerning decline in job growth. Dedicated efforts to embrace innovative recruitment methods to get ahead of future labor shortages and remain nimble amid economic flux could steer the regional industry once more toward prosperity. However, for now, the industry's short and medium-term prospects are trending in the wrong direction.

He has extensive experience advising on mergers, acquisitions, and divestitures. He has served as a Technical Reviewer for the American Institute of Certified Public Accountants’ (AICPA) construction audit and taxation guides for more than two decades and chaired the AICPA National Construction Program Conference Committee from 2012 to 2014.