The Big Picture

The new legislation offers construction a sustained capital infusion over the next five to seven years that will provide longer-term opportunities for growth, while helping to shore up America’s aging infrastructure.

But to capitalize on the windfall, the industry must find ways to offset a shrinking labor pool. Contractors must find innovative ways to attract talent – whether through vocational partnerships, in-house training, higher wages or other incentives. And amid increasing pressure to offset climate change, the industry will need to moderate its own practices and move toward lessening its impact on the environment.

In the Short Term

Every $1 billion of infrastructure investment requires 3,000 construction workers. That’s a tall order for an industry already facing a prolonged labor shortage that the pandemic has worsened. There were 344,000 open U.S. construction jobs in August 2021 – 38 percent more than the five-year average of 249,000 monthly openings.

The labor shortage could be further exacerbated by federal government vaccine mandates as construction worker vaccine rates continue to remain low; only slightly more than half of construction workers have their shots, compared to about 80 percent in occupations overall, data from the Construction Center for Research and Training shows. Meanwhile, supply chains and materials prices remain volatile, with steel, copper and fabricated metals all currently inflated. Pricing volatility makes it difficult to bid on jobs.

- Will the Biden administration lay out clear incentives that encourage the building industry to work toward carbon neutral operations?

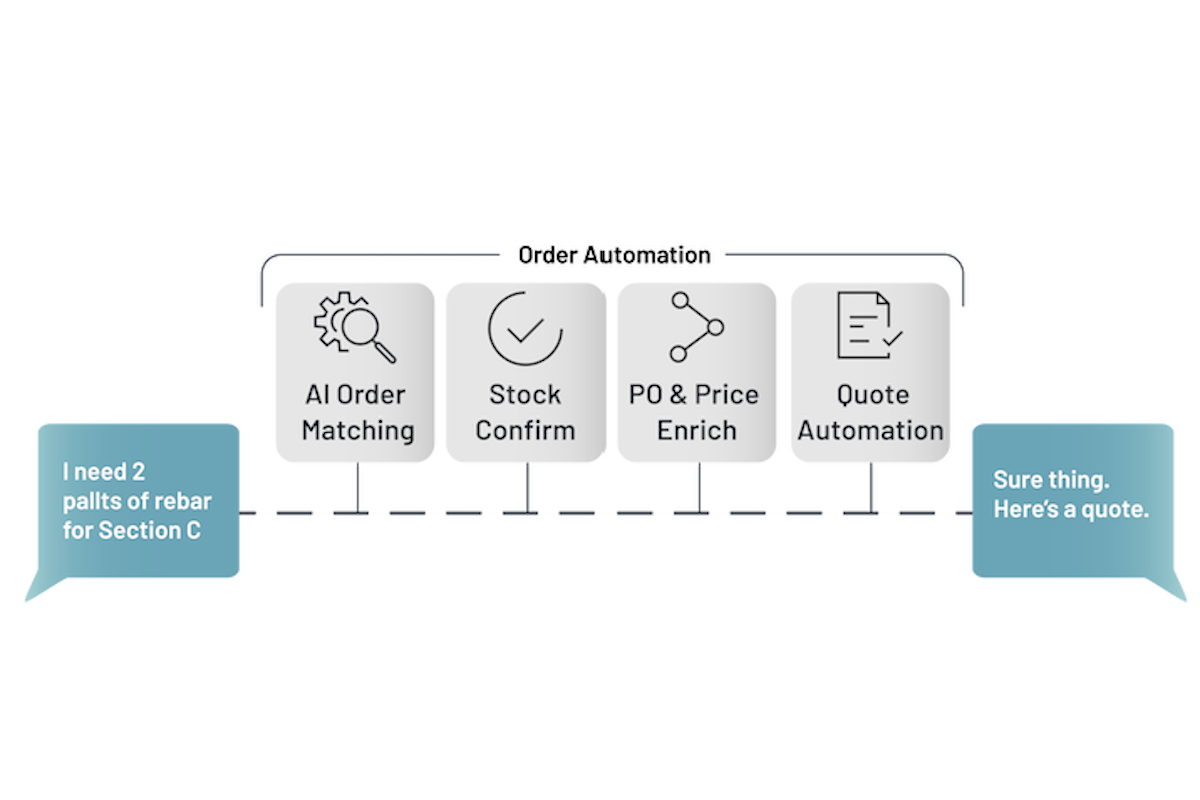

- Will the promise of new opportunity around infrastructure promote a wave of technological innovation in an industry slow to adapt but faced with ongoing labor challenges?

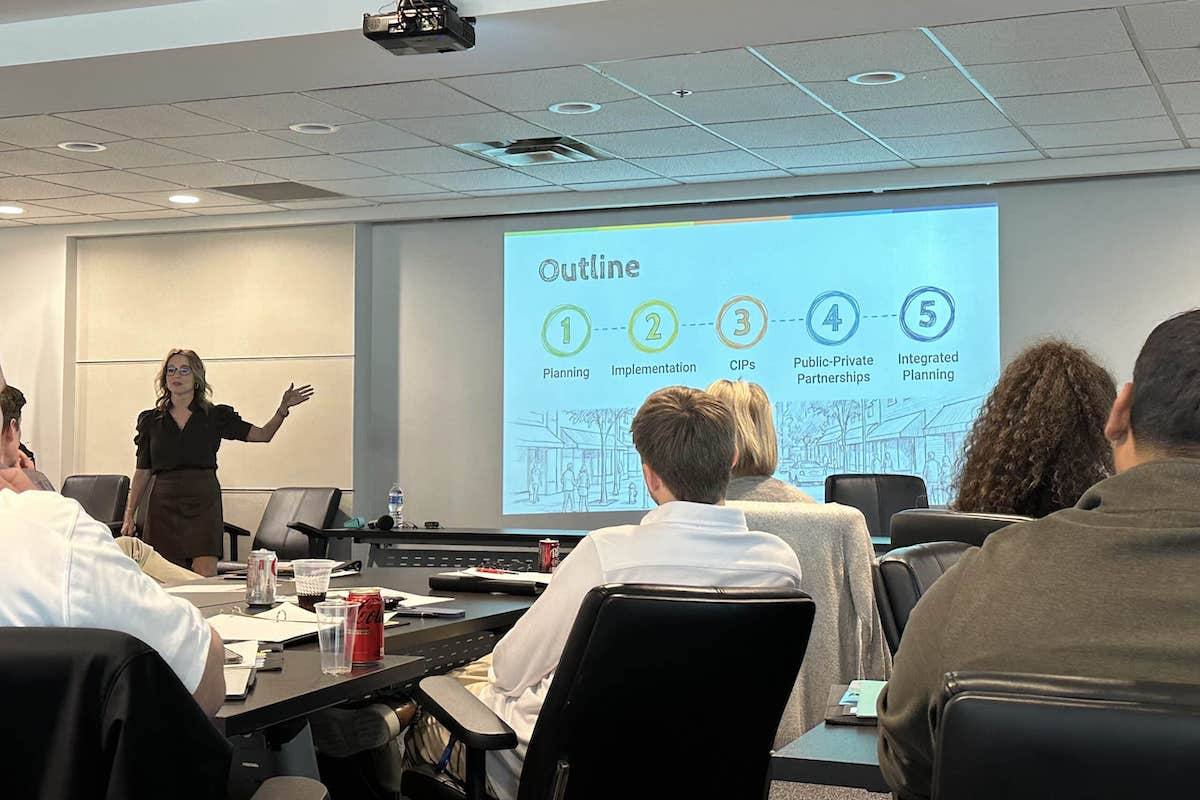

- As funding allocated to the states (representing $433 billion) does not cover necessary funds for all infrastructure gaps, how will states prioritize projects to be funded and communities served by these projects?

- How will the infrastructure package be funded? Will it lead to higher tax rates on wealthy individuals? What alternative funding sources may be tapped?

| Your local Liebherr Construction Eq dealer |

|---|

| Nueces Power Equipment |

Check out the tax implications of the Infrastructure Investment and Jobs Act at rsmus.com. And for more information on tax policy changes, see RSM’s Tax Policy Resource Center.