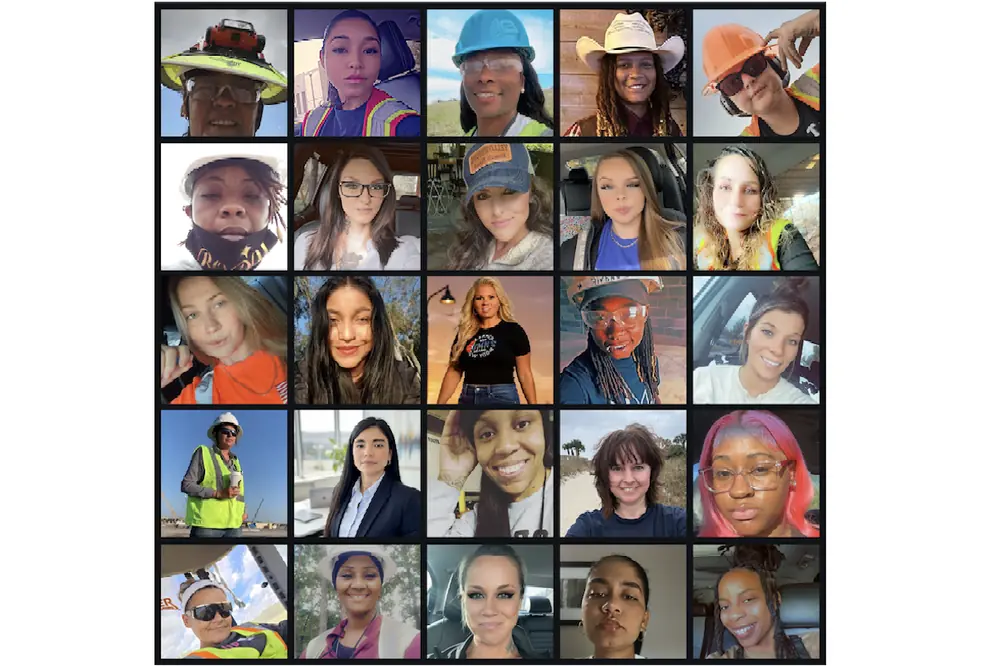

Forty-two percent of the North American workforce in CRE are women, a 3.7 percent increase from 2021, reported NAREIM’s “Global Real Estate DEI Survey 2022,” which collected 210 responses from organizations representing more than 357,000 full-time employees and $2.3 trillion in total gross assets under management. Women now hold 31.9 percent of CRE’s board seats, up from 29.6 percent in 2022, according to the 2023 Bisnow Diversity, Equity, and Inclusion (DEI) Special Report, which tracked diversity across 89 of CRE’s largest firms. Women in the C-suite have also gained representation, increasing to 26.2 percent in 2023, up from 25.6 percent in 2022 and 23.5 percent in 2021, according to the same report.

Boosting the female roles at all levels makes good business sense. Research from McKinsey, Credit Suisse, and other prominent organizations has shown that diverse teams outperform homogenous groups and lead to more creative problem-solving. More women in leadership positions could help commercial real estate develop innovative solutions for everything from deal sourcing and fundraising to strategies for operations and investment.

But a commitment to DEI requires more than just evening out the numbers of men and women; the industry needs to actively cultivate a culture of diversity to foster collaboration and innovation.

According to Preqin data as of January 2023, examining the workforce in every asset class, female employees in real estate as a proportion of total employees only grew 3.5 percent globally from 2019 to 2023. Also concerning is the lack of representation within investment teams; the “2024 Preqin Private Capital Compensation and Employment Review” of 84 leading private capital real estate firms worldwide revealed that women at private capital firms hold only 21 percent of those roles versus 69 percent in operations and 77 percent in investor relations.

| Your local ASV dealer |

|---|

| CLM Equipment Co |

| CLM Equipment Co |

Even as women gain representation in CRE, the gender wage gap has continued to widen, with women earning far less than their male counterparts. According to a leading benchmark survey of the industry, conducted every five years by CREW (Commercial Real Estate Women), the total average earnings for women in CRE were 34 percent less than men, up only 11 percent in the five years from 2015 to 2020. The CREW survey polled 2,930 industry professionals across CRE.

Fundraising remains a major challenge in the current market as investors pull back from CRE and focus their limited capital allocations on established fund managers. However, institutional investors appear to be leaning into the diversity discussion and asking for information on the makeup of investment teams seeking to raise funds. Another recent McKinsey report, “The state of diversity in global private markets: 2022,” which surveyed 42 PE firms globally, showed that institutional investors would allocate as much as two times more capital to a gender-diverse deal team whose track record matches a less diverse one. Even more surprising, 40 percent of respondents would still allocate more capital to a gender-diverse deal team despite lower historic returns. This trend presents a tremendous opportunity for women-led PE fund managers.

The post-pandemic landscape is characterized by increased flexibility across corporate America. Many organizations have opted to offer their employees hybrid or even fully remote work options. This new working environment has allowed companies to retain more staff and tap into a larger, more geographically diverse talent pool, helping mitigate the significant challenges brought on by low unemployment and a competitive labor market.

All demographics have benefited from increased flexibility. “Women in the Workplace 2023,” a McKinsey study, reports that men and women alike rank flexibility among the top three employee benefits. Flexibility, however, has been particularly important to working mothers, who are generally the primary caregivers of their children. In fact, based on data from the same study, one in five women says flexibility has helped them stay at their organization or avoid reducing their work hours.

The lack of flexibility is an obstacle CRE companies need to recognize still exists in the industry, particularly on investment teams emphasizing uninterrupted investment pipelines amid severely constrained deal sourcing in the current market. A common perception we hear among women in the industry is that investment teams need an office presence and work extended hours to identify capital and actively manage investment portfolios, leaving little time for home responsibilities.

Meanwhile, while remote work policies have been institutionalized by a host of companies, executives' outlook on physical office space continues to evolve. Forty-six percent of respondents in the Q4 2023 RSM US Middle Market Business Index survey said their organizations plan to increase their number of physical workspaces over the next two years, up from 25 percent a year ago. The percentage is even greater among executives at large firms ($50 million to $1 billion in annual revenues), rising to 72 percent from 35 percent last year.

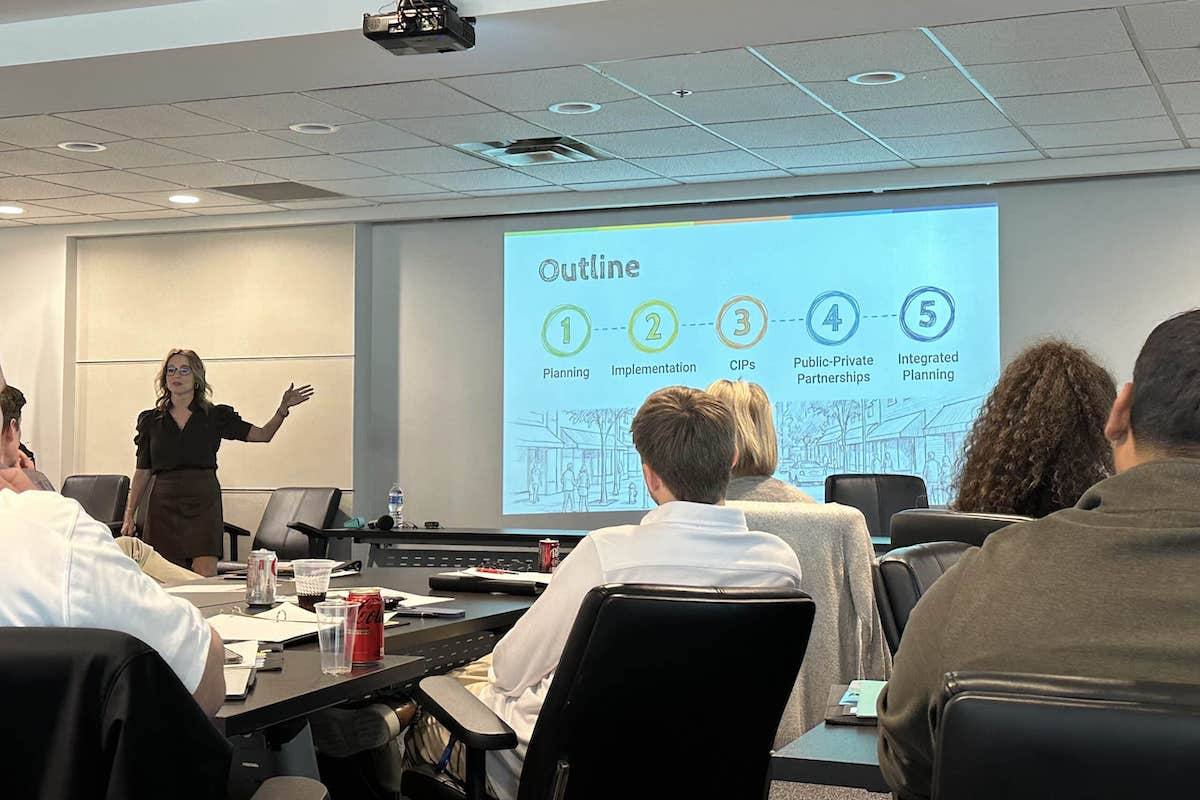

Achieving more representation of women in CRE requires a multifaceted approach that incorporates strategies for advancement, alignment of incentives, the building of external partnerships, and normalizing workplace flexibility. Here are the key actions that CRE companies can take to improve female representation in their workforce and leadership:

- Normalize flexibility: Companies need to establish a level playing field for different work arrangements to mitigate biases that exist between in-person and remote workers. They need to coach managers and leaders on eliminating flexibility stigmas and ensure equal opportunities and performance reviews among workers with different work arrangements.

- Promote advancement and retention: Mentorship programs and business networking groups are effective tools for women to build internal networks. Participation by men should be encouraged, as allyship is key to gender balance and the advancement of women.

- Build external partnerships: Many CRE companies have very lean operating structures that don’t support internal programs; support from external organizations can fill that gap. By partnering with professional organizations focused on the advancement of women — such as CREW and Women in Real Estate — companies can expand business relationships and recruiting efforts to benefit the entire company, not just female employees.

- Align incentives: While many DEI programs may exist, very few are effectively measured for success. Managers should have specific, identifiable metrics to track their performance in improving women’s program participation. Linking DEI efforts to goals and metrics that are tied to compensation and incentives keeps initiatives top of mind for managers and leaders.

Diversity of teams and leadership equates to opportunities for innovation. By implementing strategies to bring more women to the boardroom table, CRE companies can build DEI cultures that can more creatively think through industry challenges and solve for a more equitable future.