What will 2026 look like for the construction industry? For your business? We asked industry experts for their thoughts, tips, and cautions for the coming year.

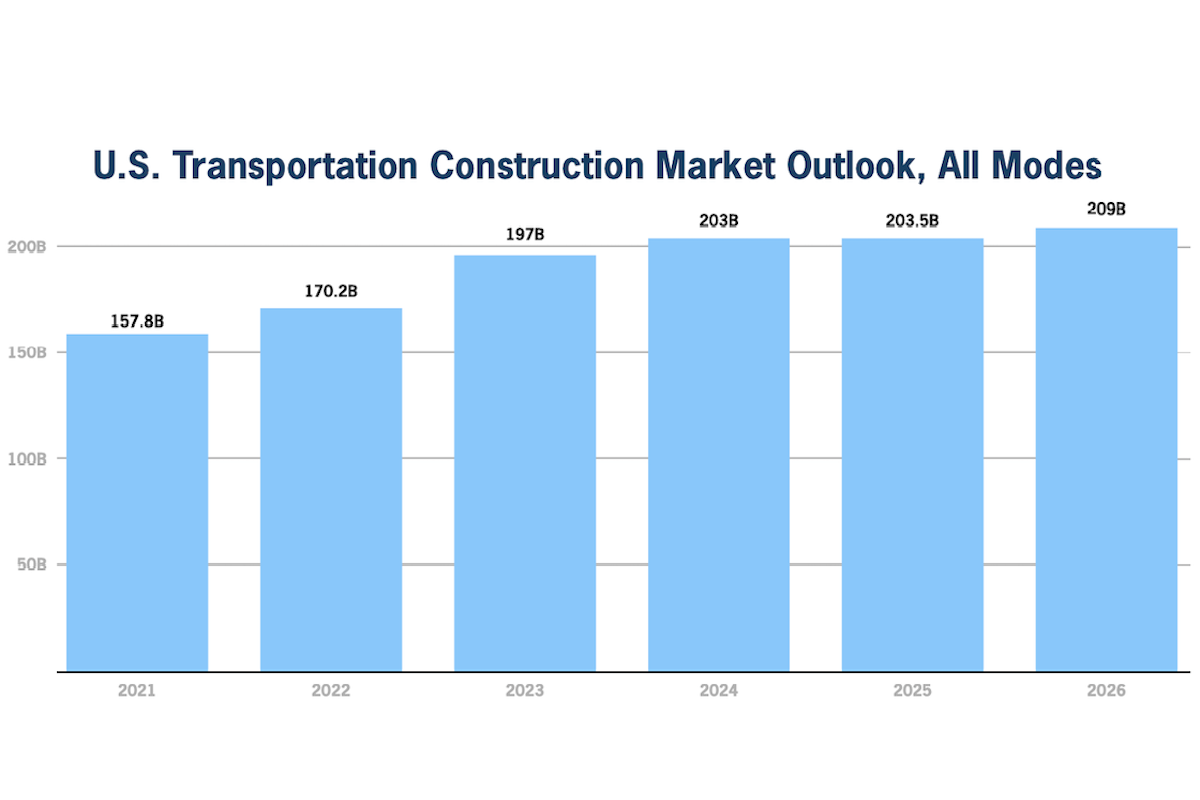

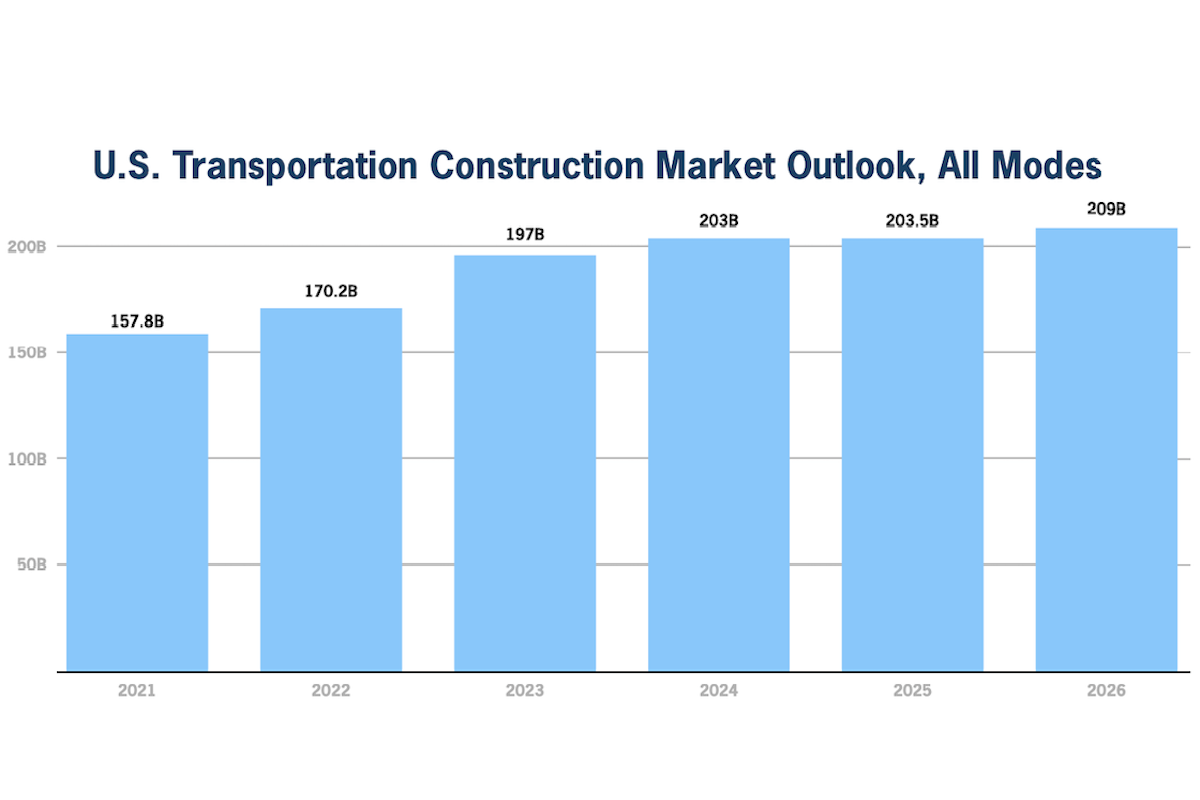

According to Dr. Alison Premo Black, Senior Vice President and Chief Economist for the American Road & Transportation Builders Association (ARTBA), after a steady year in 2025, the U.S. transportation construction market is expected to grow nearly 3 percent in 2026 to a record $209 billion.

"This will be driven by steady federal investment, healthy state budgets, and an increase in contract awards and construction backlogs,” she said.

"Looking ahead, state budgets and capital investment line items grew in fiscal year (FY) 2026, indicating continued capacity to undertake transportation construction work over the state fiscal year, which began July 1 for most states,” Black said. “State departments of transportation budget authority reached $215.6 billion in FY 2026, up from $211.2 billion in FY 2025.”

Transportation construction market activity is expected to increase or be steady in two-thirds of U.S. states, according to Black. Based on recent state and local government contract awards, some of the largest markets expected to show growth are California, New Jersey, North Carolina, New York, Illinois, Georgia, and Virginia.

| Your local Trimble Construction Division dealer |

|---|

| SITECH Central LLC |

| SITECH Midway |

Going forward, "The outlook through 2030 is also positive, as projects supported by federal and state investments continue to move through the construction phase,” Black said. “Average annual growth over the next five years is expected to average 2-3 percent per year, assuming steady federal and state investments, and a growing U.S. economy.”

But therein lies the risk. With the Infrastructure Investment and Jobs Act (IIJA) expiring on September 30, 2026, advocacy efforts are underway to reauthorize federal funding at the same or higher levels. At the same time, labor shortages and material cost volatility threaten to erode margins. The coming year will be defined by contractors’ ability to manage this knife-edge, transforming current opportunities into sustainable profit.

The federal surface transportation program continued to provide record levels of funding for highway, bridge, and transit work as the last year of authorized funding got underway October 1, 2025. Historically, the uncertainty surrounding reauthorization can cause states to pause projects, but industry leaders and policymakers are working hard to prevent a funding gap.

"Bipartisan interest in advancing a new federal surface transportation bill remains strong, as committees are working together on new legislation,” said Lauren Schapker, ARTBA’s Vice President, Legislative Affairs. “Though the government shutdown shifted timelines, action on a new bill is expected [this] spring, leaving plenty of time to come to agreement by the current law’s September 30 expiration."

| Your local Gehl Co dealer |

|---|

| Star Equipment LTD |

Many advocates have been communicating with members of Congress to share industry priorities. In December 2025, the Move America Coalition, led by the U.S. Chamber of Commerce along with more than 20 industry trade associations and labor unions, announced its engagement in the push for timely reauthorization and long-term infrastructure investment. The group also prioritized stabilizing the Highway Trust Fund through a user-based, predictable funding strategy.

For Associated General Contractors of America (AGC), “In addition to pushing for sufficient funds, we continue to push for the kind of permitting and regulatory reform that will allow those funds to be put to use more rapidly into improving the nation’s transportation networks,” said Brian Turmail, AGC’s Vice President of Public Affairs and Workforce.

As the funding issue plays out in Congress, contractors face more immediate risks to their profitability.

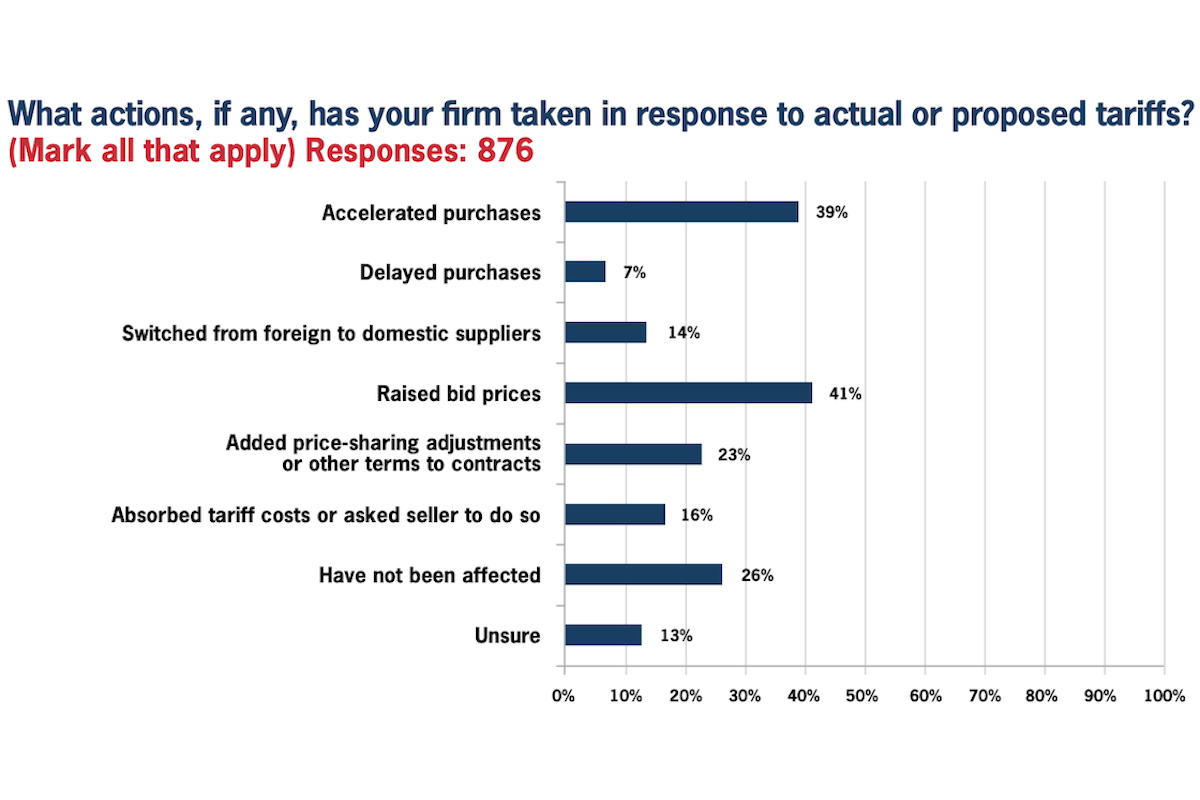

“Tariffs and rising material costs have pushed infrastructure project costs higher and increased risk throughout the bidding environment,” Turmail said. “An environment of uncertain trade policy, paired with elevated steel, aluminum, and equipment prices, is discouraging bidder participation as contractors become more cautious about taking work with thin or uncertain margins.”

| Your local Link Belt dealer |

|---|

| Kirby-Smith Machinery |

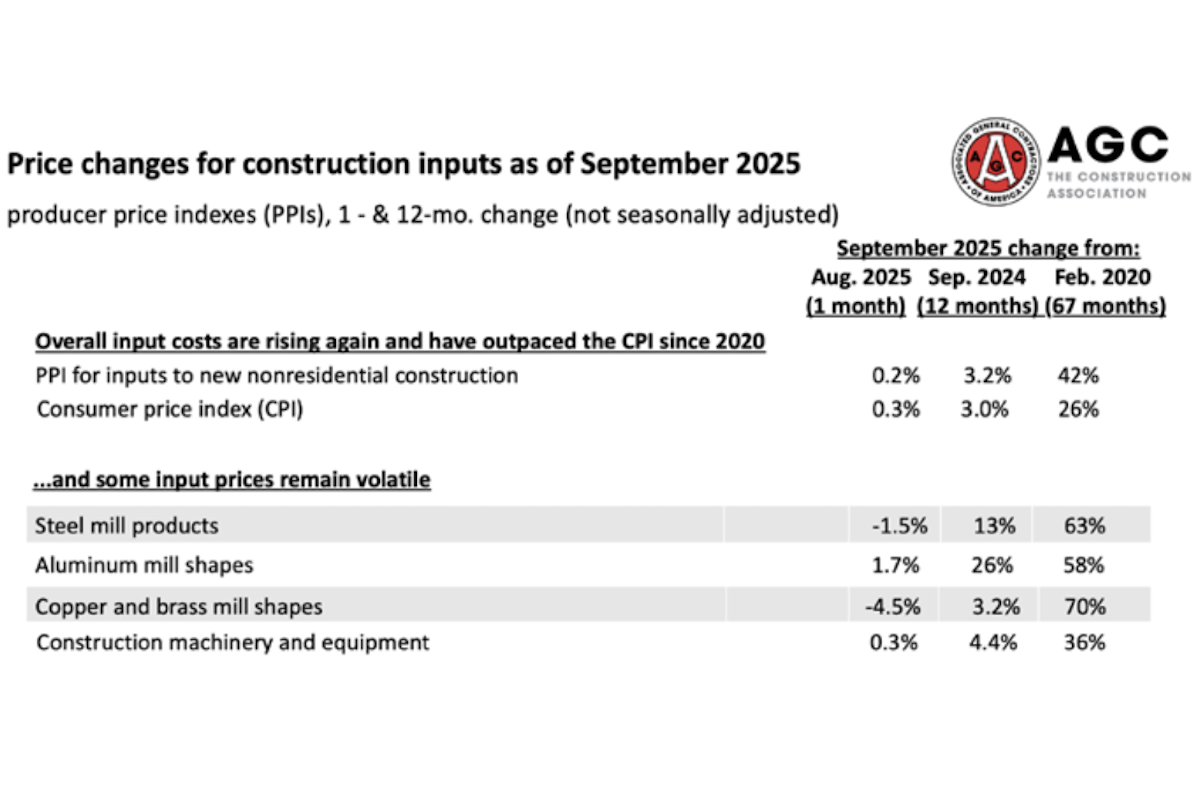

Recently, material cost pressure reemerged across several core inputs for civil and infrastructure work.

“The Bureau of Labor Statistics’ Producer Price Indexes (PPI) show that key materials such as steel and aluminum have reversed earlier declines and are moving higher again,” Turmail said. “Steel mill products were up 13 percent year over year in August [the most recent numbers available at this writing], and some specialized structural components saw even larger increases due to limited supply and tariff effects. Aluminum mill shapes rose 23 percent over the year, reflecting tight domestic capacity and high energy requirements. Even materials that typically move more gradually, such as gypsum and cementitious products, remain sensitive to freight conditions and elevated energy costs, adding another layer of uncertainty for contractors planning 2026 bids.”

Turmail expects these pressures to shape project delivery in the coming year. “While dramatic spikes seem unlikely, input-price increases, tariff uncertainty, and ongoing supply-chain friction will continue to cause swings in steel, equipment, and freight costs, complicating bidding and planning,” he said. “Contractors should expect more cautious bidding behavior, wider contingencies, and a continued preference for projects with predictable quantities and shorter lead times.”

In addition, “Financing conditions will remain a headwind,” Turmail said. “Even if interest rates ease slightly, borrowing costs will stay elevated compared to pre-pandemic norms. For many owners, higher financing costs make projects harder to justify and can lead to delays, downsizing, or shifts toward renovation instead of new construction.”

| Your local Topcon Positioning Systems Inc dealer |

|---|

| Star Equipment LTD |

To maintain profitability, contractors will need a proactive, multi-pronged strategy.

First Line of Defense: The Contract

Moving beyond standard language can mitigate unforeseen economic shifts. Consider these options:

- Implement price escalation clauses — Clearly define a mechanism for adjusting the contract price if material costs for key inputs (like steel, rebar, asphalt, or concrete) rise above a certain, predefined threshold or index (for instance, a 5 percent increase or a rise beyond the PPI benchmark). Allow for downward adjustments if prices fall. This makes the provision more palatable to project owners and fosters trust.

- Draft strong change-in-law provisions — Ensure your contracts define new tariffs as a "change in law" or governmental regulation that entitles the contractor to an equitable price adjustment.

- Use clear expiration dates on bids — Short, firm expiration dates protect you from absorbing material price increases that occur between bid submission and contract award.

- Incorporate allowance provisions — For high-risk, volatile materials, use an allowance or flexible budget instead of a fixed price, with the final cost adjustment based on the actual, documented procurement cost. Strategic Procurement and Supply Chain Management

- Prepurchase critical materials — For materials with predictable usage and sufficient storage space, early procurement can lock in prices and hedge against future tariffs or inflation. Be sure to model the cash flow impact and compare storage costs against projected price increase risks.

- Diversify and localize the supply chain — Reduce reliance on single-source or import-heavy suppliers. Cultivate relationships with domestic suppliers and explore multiple sourcing options.

- Negotiate long-term, fixed-price agreements — Leverage your buying power to negotiate contracts with suppliers that lock in prices for the project's duration. Include clauses that require suppliers to provide baseline cost data at the time of contract signing to easily validate future price claims.

- Maximize early involvement and value engineering — Whenever possible, work with designers and engineers in the preconstruction phase to identify materials requiring early procurement or possible alternatives. Collaboration and Financial Planning

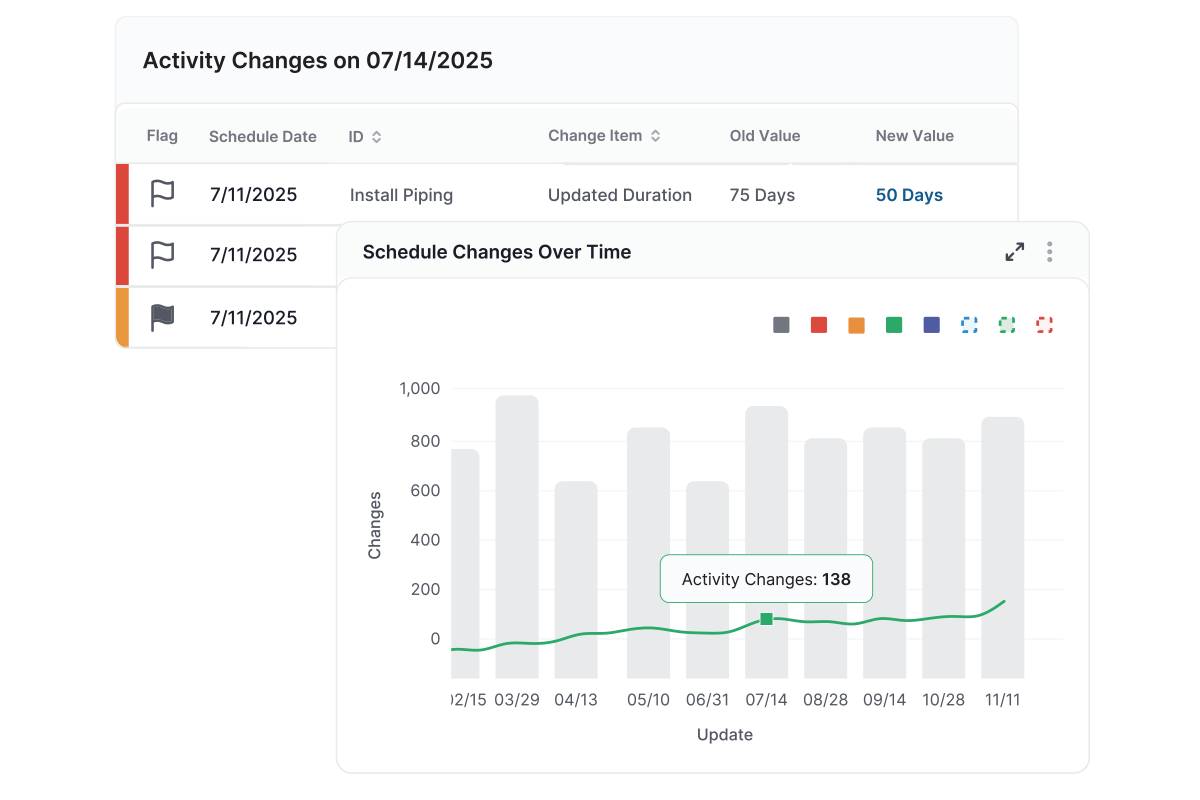

- Enhance cost forecasting — Utilize technology and tools like the Producer Price Index to develop scenario planning and a more accurate forecast of material costs over the project's duration.

- Maintain proactive communication — Openly discuss with clients the risks of material cost volatility from the outset. Regular, formal updates on supply chain risks and cost forecasts help manage expectations and make change order approvals smoother.

- Model and adjust contingency funds — Incorporate a higher contingency budget backed by data-driven risk analysis, specifically for materials prone to cost increases.

Aggressive, data-driven procurement is essential to locking in costs and diversifying exposure. For instance:

Transparency and preparation are key to managing client and financial expectations in a volatile market. Work to:

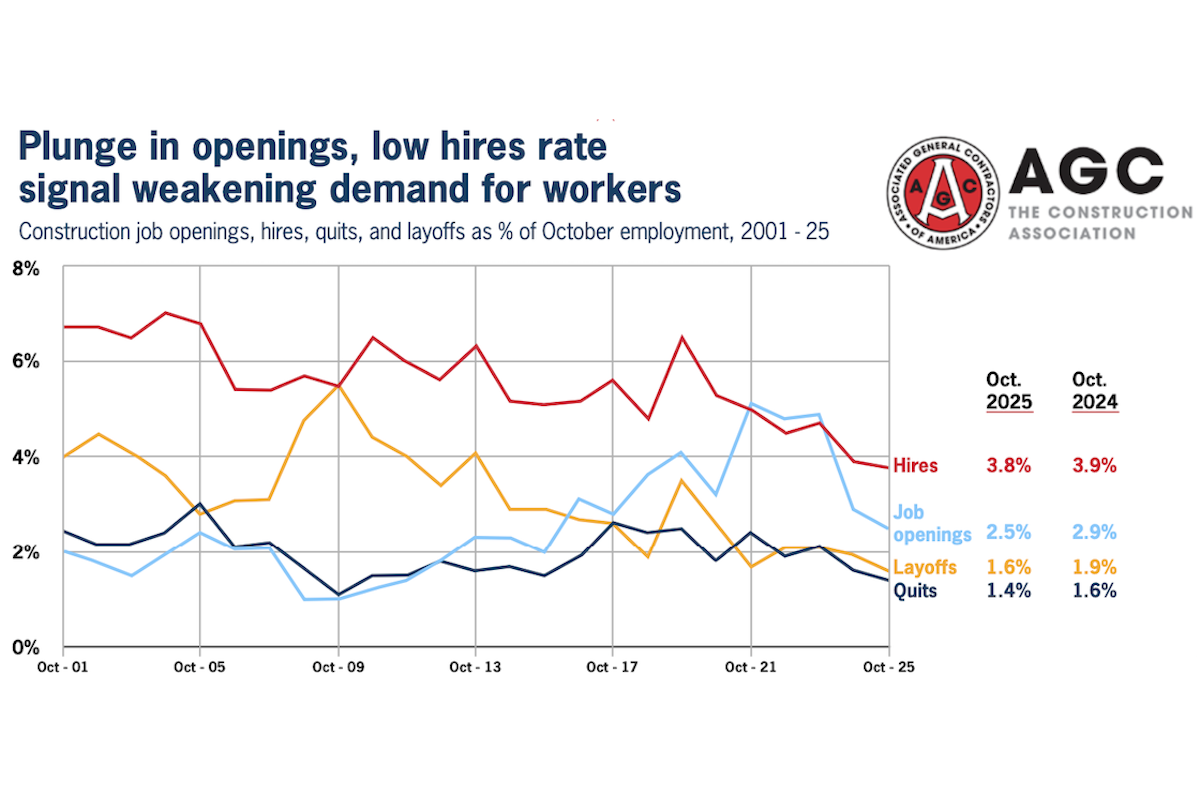

Amidst all the volatility, the labor market remains the most persistent long-term challenge. The skilled trades workforce is shrinking as experienced workers retire. According to the U.S. Bureau of Labor Statistics, more than 20 percent of construction workers are 55 or older and the median age is 42. Finding and keeping new talent requires a comprehensive approach.

“To attract talent, contractors are increasing compensation packages and engaging with vocational schools, trade associations, and municipalities to provide development opportunities for new workers,” said Ryan Powers, Senior Vice President, Head of Construction, for insurance firm QBE North America. “As the industry welcomes new workers, it is crucial to stay focused on safe work environments and protecting fellow laborers, especially given the higher risk of injury among inexperienced workers.”

| Your local Gomaco dealer |

|---|

| Fabick CAT/MO |

| Road Machinery and Supplies Company |

In the 2025 Workforce Survey conducted by AGC and the National Center for Construction Education and Research, over 90 percent of respondents reported difficulty filling craft and salaried positions. Although job growth slowed in 2025, “Strong wage growth and competition for experienced craft labor affect schedules, productivity, and total project cost,” Turmail said.

Compounding the challenge, the industry’s reliance on foreign-born labor — which accounts for roughly one-quarter of all construction workers — has been severely impacted by stricter immigration policies and increased enforcement.

AGC created a number of resources to help members prepare for enhanced immigration enforcement efforts. “Meanwhile, we continue to advocate for measures in Congress that will expand the number of people legally authorized to work in construction,” Turmail said. “This includes supporting both the Dignity Act and the Essential Workers for Economic Advancement Act. The first bill creates a path to more permanent legal status for a host of workers already in the country, while the second measure establishes a new category of visa available for construction.”

“Looking ahead to 2026, civil and infrastructure contractors should prepare for a steady but more cautious market,” Turmail said. “Economic growth is expected to cool, and owners may take a more deliberate approach to project timing and scope. As IIJA funding peaks fade, spending levels are unlikely to match the highs of the past several years, and public activity may be further shaped by state budget pressures and uncertainty around future federal allocations.”

| Your local Leica Geosystems Inc dealer |

|---|

| Laser Specialist inc |

As we’ve seen, a lot can change in a year.

In 2026, “Volatility in materials and policy will remain key factors,” Turmail said. “Tariffs, immigration enforcement, and recent interest-rate changes all influence project affordability and material availability. The result is a year with steady underlying demand but elevated risk, where flexibility and disciplined cost management will matter just as much as backlog.”

The firms that thrive will be those that master the art of risk mitigation. Opportunities are there; the challenge is executing the work profitably.