It is not a stretch to say the presidential election of 2024 is unlike anything we have seen before. The two major parties have yet to officially declare their candidates, but we know the presumptive nominees: Vice President Kamala Harris for the Democrats and former President Donald Trump for the Republicans. There is also an independent candidate, Robert F. Kennedy Jr.

Each of these candidates offers positive and negative attributes with fully committed followers. Yet for all intents and purposes, the race is really between Vice President Harris and former President Trump.

The election is still months away and a lot more can change between now and November 5, 2024. The domestic economy may be the primary driver of outcomes, but it is clear the global geo-political environment is changing and less stable than before the pandemic.

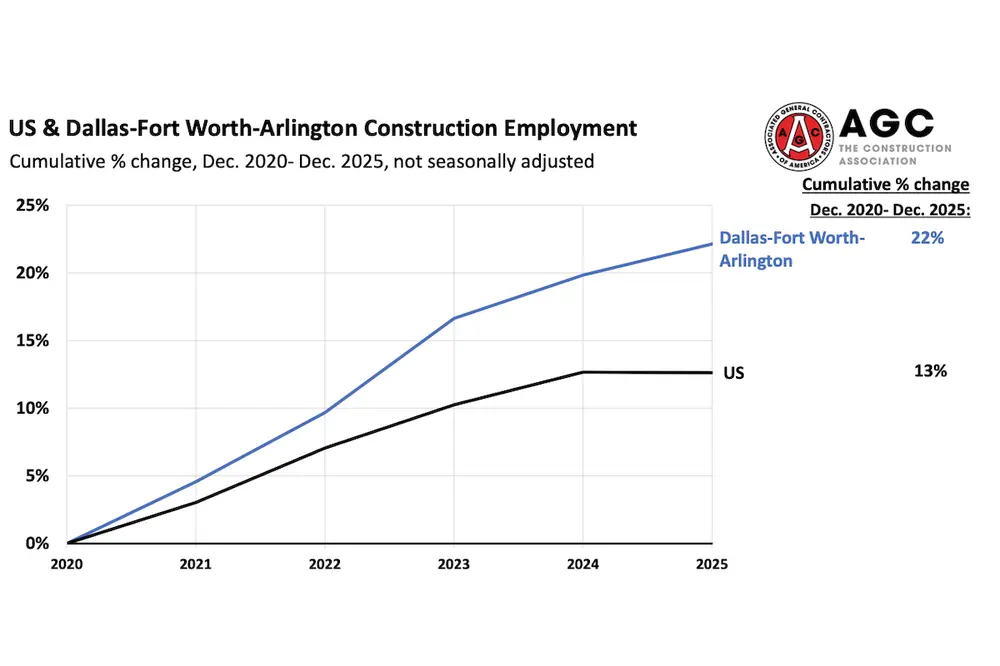

Speaking of the pandemic, the policy responses to shutting down the economy — both monetary policy and fiscal policy — must be deemed an economic success. Unemployment as of May 2024 remained below 4 percent for 27 straight months, a period not seen in this country since the 1960s. Gross Domestic Product (GDP) growth remains positive despite higher interest rates, and domestic growth has far outperformed our developed country peers.

| Your local Trimble Construction Division dealer |

|---|

| SITECH Allegheny |

| SITECH Northeast |

But we are paying a price for these actions as inflation remains above the Fed’s target and our fiscal position remains in a large deficit. Inflation is trending lower, and while fiscal spending is additive to growth in the short term, there are potential negative implications we will have to deal with going forward.

The Biden/Harris administration, like every incumbent administration regardless of party affiliation, has the advantage of being able to act on some issues while in office. There have been recent announcements about raising tariffs on Chinese electric vehicles, potential action on immigration and the asylum process, and ongoing actions to forgive some student loans.

In addition, previously passed bills — the Infrastructure Investment and Jobs Act, the CHIPS and Science Act, and the Inflation Reduction Act — assure additional fiscal spending over the course of 2024. These actions, along with the potential to release $60 billion to $100 billion in pending Employee Retention Credits, improve the outlook for economic growth between now and year-end. These actions are not unlike actions taken by previous administrations of both parties to avoid an economic recession before an election.

However, the policy differences between the two candidates are wide. Both candidates are aware the global economy is becoming more polarized, which is leading to both parties considering tariffs of some sort, although the level and breadth of tariffs is different. On issues like taxes, regulation, immigration, and energy policy, there are significant differences. (See "Major Policy Differences" table with photos above.)

While policy differences could lead to big changes, we must also consider that the president must act in concert with Congress on many issues. Here, the close divide between the two parties will mean any president will have difficulties passing significant legislative actions.

One-third of the Senate is up for re-election this year, as is the entire House of Representatives. The math of the Senate elections provides an advantage for Republicans to retake a majority, but the House looks to be almost evenly split.

Even during recent periods when Republicans or Democrats held the presidency along with majorities in the Senate and House, differences on an intra-party basis made major legislative changes difficult. All of this indicates that the wide range of policy differences between presidential candidates will have a difficult time being implemented — which means the actual impact of the elections might be more of the same.

COVID-19 laid bare the risks of our economy having so much production overseas. Goods were difficult to attain and supply chains were clogged. The invasion of Ukraine by Russia and our response of cutting off Russian access to their dollar-denominated reserves has led to a growing number of countries finding ways to trade amongst themselves without using the dollar.

From a positive standpoint, we have seen several companies begin to invest in production facilities domestically and move manufacturing facilities to areas where they have more control over production and distribution. These actions can be additive to our domestic economic outlook but might also mean inflation stays a bit higher, keeping rates a bit higher.

Our sense is the next move from the Fed is to lower rates, but we do not anticipate a move down to the low levels we saw during the pandemic. In fact, we hope they do not go that low, as doing so would mean we have had a very bad economic outcome with a deep recession and much higher unemployment.

Longer term, elections are not the most impactful events for the economy and markets. The concept of managing your business remains much the same regardless of who is president and which party is in control of the Senate or House of Representatives.

The close divide of our country makes major shifts one way or the other slow and difficult. In the big picture, that is not a bug but a feature of our political process. Our success will be driven by companies and individuals working hard to improve lives and solve problems. From that lens, we remain highly optimistic and believe the best is yet to come.

BOK Financial is a trademark of BOKF, NA. Member FDIC. Equal Housing Lender. 2024 BOKF, NA. Click here for the full BOK Financial disclosure.