Economic and policy uncertainty continue to hang heavily over economic prospects for middle market businesses heading into the critical holiday season that marks the final quarter of 2025.

Firms grew slightly more pessimistic in the third quarter despite relief that lies ahead in 2026 due to pro-growth expansionary fiscal policy.

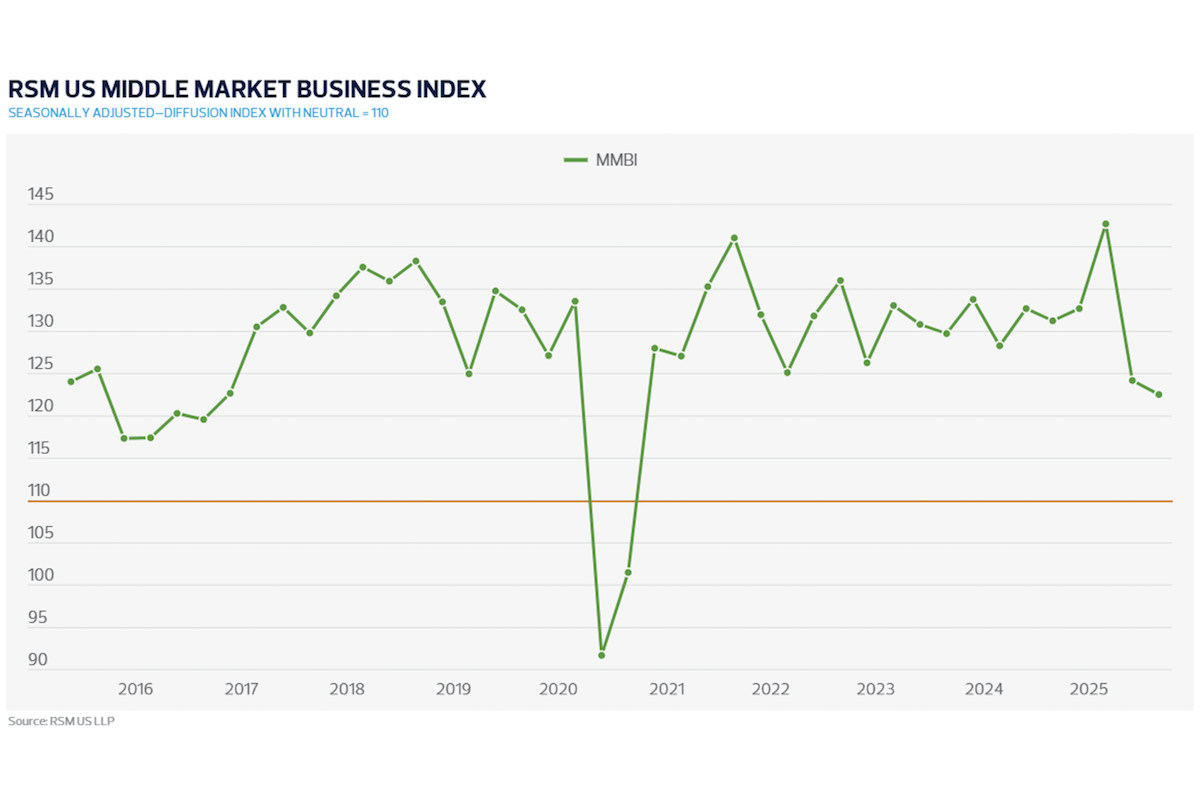

That general uncertainty resulted in a modest decline in sentiment from 124.2 to 122.5 in the RSM US Middle Market Business Index. Both figures stand below the four-quarter moving average of 130.5.

The data underlying the topline index strongly suggests that middle market firms appear to be absorbing an increase in prices paid, and they face a limited ability to pass those costs along downstream. This implies narrowing profit margins as the rising cost of goods, driven by trade policy, sets the stage for a challenging conclusion to 2025.

Sixty-seven percent of survey participants reported an increase in prices paid for goods and services in the third quarter of 2025, while the same percentage also expect to pay higher prices into 2026.

| Your local ASV dealer |

|---|

| CLM Equipment Co |

| CLM Equipment Co |

Only 48 percent of respondents indicated that the prices their organization received for all of its goods and services this quarter versus last quarter increased, down from 56 percent previously. However, 62 percent of respondents expect to raise prices. RSM believes organizations will pass along these increased costs to consumers, which could contribute to rising inflation pressures into the next year.

The average U.S. tariff rate at the time of this writing is 9.75 percent — up from the 25-year average of 1.4 percent — and we expect it to move toward 18 percent over the next two months based on the public tariff schedule.

This suggests thinning profit margins will drive the economic narrative for middle market firms until a sense of certainty regarding trade and policy is restored.

Inventory management, during what has been a volatile year at the ports due to rising trade taxes, is clearly a concern among middle market businesses that pulled forward goods orders in late 2024 and during the first three months of this year to avoid rising tariffs.

| Your local Trimble Construction Division dealer |

|---|

| SITECH SE Texas |

| SITECH Tejas |

| SITECH SE Texas |

| SITECH Tejas |

As one would expect, inventory accumulation slowed during the third quarter. Only 35 percent of respondents said they increased stock on hand, while 44 percent indicated they intend to do so over the next six months.

With the public tariff schedule signaling sharp price increases ahead for raw and intermediate goods, inventory issues and a potential price shock may be in store for the holiday season.

Middle market views on the economy remain somewhat sour as a result, with only 37 percent of respondents stating that the economy improved during the third quarter.

However, 50 percent said they expect improvement over the next six months since a tax cut is on the way.

| Your local Wirtgen America dealer |

|---|

| Nueces Power Equipment |

| Nueces Power Equipment |

Gross revenues and net earnings also remained somewhat challenged. Thirty-nine percent of respondents said revenues improved during the current quarter, while 43 percent said net earnings rose.

Over the next six months, commensurate with next year’s pro-growth tax policy, 58 percent of respondents expect revenues to increase and 60 percent expect net earnings to improve.

Capital expenditures in the current quarter appeared to have slowed. Only 38 percent of respondents noted that they increased outlays on productivity — enhancing software, equipment, and intellectual property, whereas 50 percent said they intend to do so over the next six months.

Middle market businesses, like their large and small counterparts, have clearly slowed the pace of hiring. Thirty-four percent said they increased hiring in the current quarter, while 46 percent said they will do so over the next half a year.

| Your local Broce Broom dealer |

|---|

| Nueces Power Equipment |

| Nueces Power Equipment |

Not surprisingly, 43 percent said they increased compensation to attract labor in the third quarter, compared to 54 percent who think they will need to do so in the near term.

The percentages reporting an increase in borrowing in the current quarter and over the next six months remained relatively stable, at 26 percent and 32 percent, respectively.

“It is clear that the benefits from the recent enactment of the tax bill — greater certainty and reduction in the after-tax costs of capital investments — are being eroded by tariffs and greater than usual policy and economic uncertainty,” said Neil Bradley, Executive Vice President and Chief Policy Officer, U.S. Chamber of Commerce. “For our economy to reach its full potential, it is critical that we reduce the tariff burden, continue to reduce regulatory and permitting costs, and address persistent labor constraints.”