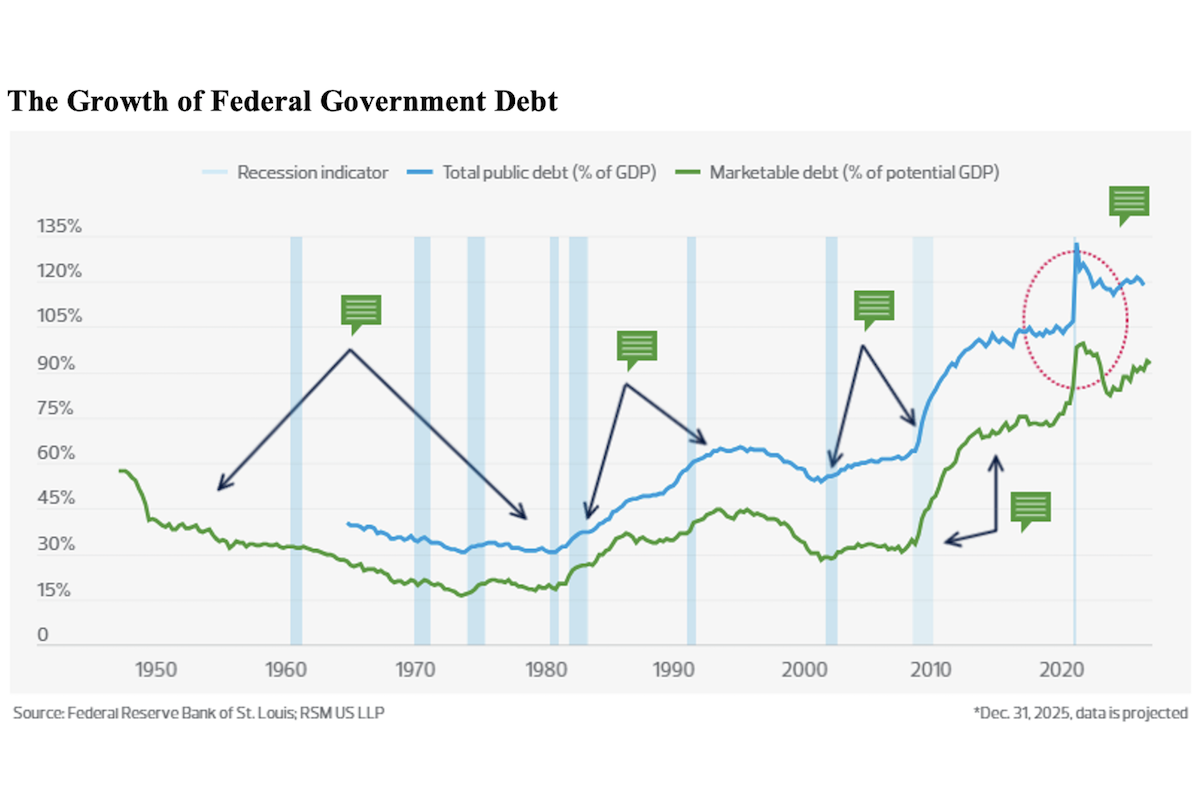

The American government budget is not on a sustainable path. The United States is borrowing roughly $7 billion per day to finance its operations, with the deficit heading toward $2 trillion this fiscal year, according to the Committee for a Responsible Federal Budget. And it’s only going to increase as expansionary fiscal policies take effect in the new year.

While the United States can find investors willing to finance its debt, a look at the primary budget deficit — the deficit excluding interest owed on past debt — now stands at 3.78 percent of gross domestic product, which is simply not sustainable. And there is little support for changing the trajectory of the primary budget deficit on either side of the aisle in Washington.

Yes, the American dollar is the global reserve currency, which allows the U.S. to live well beyond its means because of the size of the daily global currency and bond markets that are based on American finance.

But the price of money in global markets will be affected by the trajectory of U.S. borrowing, which as it increases will raise financing costs for American households and businesses. While the political sector is not focused on it, the financial sector is taking the rise in public debt quite seriously. Higher term risk premiums are being attached to U.S. public debt, and long-term interest rates are rising even as the Federal Reserve cuts its policy rate.

The surge in government debt over the past 15 years and the lack of political will on both sides of the aisle to address the issue should be a concern for all. With the post-pandemic structural shift in the global economy, higher inflation and interest rates have become the norm.

| Your local ASV dealer |

|---|

| CLM Equipment Co |

| CLM Equipment Co |

The rise in government debt has been accompanied by an increase in nonbank financial intermediation and highly leveraged short-term positions, as highlighted in a recent lecture by the general manager of the Bank for International Settlements (BIS).

These institutions are lightly regulated, which only adds to the risks.

The financial crisis from 2007 to 2009 showed just how much risk nonbank financial institutions can add to an economy. The subsequent recession required both monetary and fiscal responses that caused further distortions in financing and added to the public debt.

In the end, a surge in public debt can crowd out private investment, lowering potential economic growth.

| Your local Trimble Construction Division dealer |

|---|

| SITECH SE Texas |

| SITECH Tejas |

| SITECH SE Texas |

| SITECH Tejas |

U.S. government debt compared with the size of the economy has been increasing since the 1980s.

Unfunded spending is defined as commitments to spend that are unmatched by increases in revenue, which requires the increased issuance of Treasury bills, bonds, and notes. To be sure, economic shocks like the pandemic require unfunded spending to prevent the economy from falling into a deep recession.

But during times of growth, expansionary fiscal policies should be avoided, as growth in the private sector drives an increase in tax revenues. Yet, a pro-cyclical expansionary fiscal policy is exactly what is about to occur, carrying risks of inflation and higher interest rates.

Despite the assertion that economic growth itself will close the deficit, the record of unfunded spending since the 1980s shows otherwise.

| Your local Wirtgen America dealer |

|---|

| Nueces Power Equipment |

| Nueces Power Equipment |

The real question is: How much longer will this unfunded spending prove sustainable?

Notably, the U.S. bond market has shown itself quite capable of finding buyers of that debt. Our trading partners are more than willing to fund our domestic spending in return for the guarantee of geopolitical safety and access to the U.S. consumer and financial markets.

Still, the global financial system has undergone a shift because of the surge in government debt and the ability of participants to profit from the availability of funds.

The recent overload of government debt has proved increasingly attractive for short-term speculation by less-regulated market participants.

| Your local Broce Broom dealer |

|---|

| Nueces Power Equipment |

| Nueces Power Equipment |

In contrast to previous global financial crises driven by unsustainable private sector debt and insufficient oversight, the focus of market speculation has shifted to short-term bets tied to mounting public debt.

In addition, the traditional role of banks in public finance has been usurped by the growing presence of less-regulated activity of nonbank financial institutions in sovereign bond markets. These nonbanks include investment funds, hedge funds, insurance companies, pension funds, and other financial intermediaries now able to make money on extremely short-term and highly leveraged positions.

According to the International Monetary Fund, half of all financial assets worldwide are now held by companies that are not regulated as banks.

Now, governments have new lenders providing liquidity for U.S. Treasurys, midsize businesses have gained access to new funding sources, and consumers and small businesses have more borrowing options.

| Your local Bobcat dealer |

|---|

| Central Texas Equipment |

| Nueces Power Equipment |

| Central Texas Equipment |

| Nueces Power Equipment |

What could possibly go wrong?

First, the IMF writes, the growth of nonbanks has broadened the scope for a nonbank run scenario in which money market funds make long-term investments but promise customers the ability to withdraw at any time.

A cash crisis among nonbank institutions would call for government help, with central banks taking on the risk for these nonbanks. To account for that risk, the IMF calls for improved data and risk analysis and supervision of these nonbanks.

Second, analysis by the BIS points to the growing trend of low-level haircuts in sovereign bond transactions in which the borrower uses highly leveraged funds to profit from market moves.

| Your local Komatsu America Corp dealer |

|---|

| WPI |

| Kirby-Smith Machinery |

| WPI |

| Kirby-Smith Machinery |

The BIS continues that the prevalence of zero-haircut borrowing in bilateral repo activity raises the question of who benefits from such attractive terms and what the accompanying risks are to financial stability.

The analysis suggests that larger hedge funds are able to attain high levels of leverage relative to their smaller peers, which can likely be traced to their greater market power.

This combination of unregulated nonbank participants in the sovereign debt market and highly leveraged, low-cost market positions poses a threat to financial stability. The rising risk calls for a prudent approach to both domestic and international regulation.

One clear way of measuring excessive government spending is by looking at the so-called primary deficit. This measure is traditionally defined as government revenues minus primary (noninterest) expenditures over a selected period, expressed as a percentage of GDP.

| Your local Hitachi dealer |

|---|

| ASCO Equipment |

The last time the U.S. ran a budget surplus, with yearly revenues exceeding expenditures, was from 1995 to 2001. That coincided with the productivity gains during the last six years of the Clinton administration, which carried over into the Bush administration. After that, the primary deficit exploded during the extended financial crisis and then into the pandemic.

While the primary deficit has moderated, its annual level from 2022 to 2024 remained higher than in any single year since 1983, a period marked by double-dip recessions that brought the global economy to its knees.

The primary deficit becomes a concern when the financial markets are no longer willing to risk investment in a nation’s debt.

While this is currently not a concern, if that were to change the result would most likely be a spike in interest rates, with the increased cost of financing the debt becoming a deterrent to investment and growth.

| Your local Magni dealer |

|---|

| Kirby-Smith Machinery |

The way governments view debt has undergone a sea change.

For instance, Japan has carried government debt of greater than 100 percent of its gross domestic product (GDP) for nearly 30 years. And while its economic growth has been moribund, Japan has a dominant role in sponsoring the U.S. accumulation of debt. As such, its currency has yet to come under attack, except for the surge in the dollar during the pandemic.

But Japan and the U.S. are not alone in accumulating debt. China’s debt, for example, is now reaching 100 percent of GDP.

As noted by the BIS, the prevailing political process in many countries leads to deficit bias, which has led to persistent deficits, especially during times of distress. These shocks, like the pandemic, have been associated with deep recessions, coinciding with increased spending on services for aging populations.

So yes, monetary policy and interest rates are factors in servicing debt. And interest rate payments approached 4 percent of GDP in 2025.

But measures to correct the fiscal imbalance should focus on the level of debt and the mismatch between revenues and expenditures.