The proprietary RSM US Middle Market Business Index (MMBI) rose to 132 in the quarter from 130.7 in the prior period. Since rebounding from the trough of the pandemic, the index has moved in a range of 125.5 to 140.7, which compares favorably to the pre-pandemic range of 117.3 to 138.4. The survey’s high, posted in the third quarter of 2021 as the economy snapped back from the pandemic shutdown, was 140.7.

Despite the modest improvement in confidence in the second quarter, 40 percent of executives surveyed indicated that the economy had improved; 32 percent, by contrast, said conditions had deteriorated.

In our estimation, the long tail of the pandemic and the ensuing price shock has taken a powerful toll on smaller firms, which continue to face a challenging environment of higher wages and input costs.

Companies’ willingness to invest is helping fuel a productivity boom that is currently working its way through the American economy. If it continues, this will lead to a virtuous cycle of improved growth, low unemployment, and price stability.

| Your local ASV dealer |

|---|

| CLM Equipment Co |

| CLM Equipment Co |

Nearly half of respondents, or 47 percent, indicated that gross revenues had improved, while 45 percent said that net earnings increased. Far fewer, 25 percent and 26 percent respectively, said that revenues and earnings had deteriorated. Looking ahead, 68 percent of survey participants said they expect gross revenues to improve over the next six months, and 61 percent said the same about net earnings.

This is most likely a big reason why 53 percent of respondents indicated they expect the general economy to improve. While we remain confident in the direction of middle market capital expenditures, 65 percent of executives indicated a real and abiding concern about the cost of capital.

That concern puts more focus on upcoming decisions by the Federal Reserve on its policy rate. We forecast two rate cuts of 25 basis points each this year, starting in September. The Fed’s decisions will largely shape the duration and intensity of the current business expansion.

Approximately 24 percent of MMBI respondents indicated that they expect rates to remain unchanged over the next year; 54 percent expect rates to increase; and 22 percent anticipate a decrease.

At the same time, 17 percent said they had slowed hiring. We expect hiring to slow somewhat, to a more sustainable pace, in the second half of the year as economic growth eases to a 2.4 percent average pace for the full year.

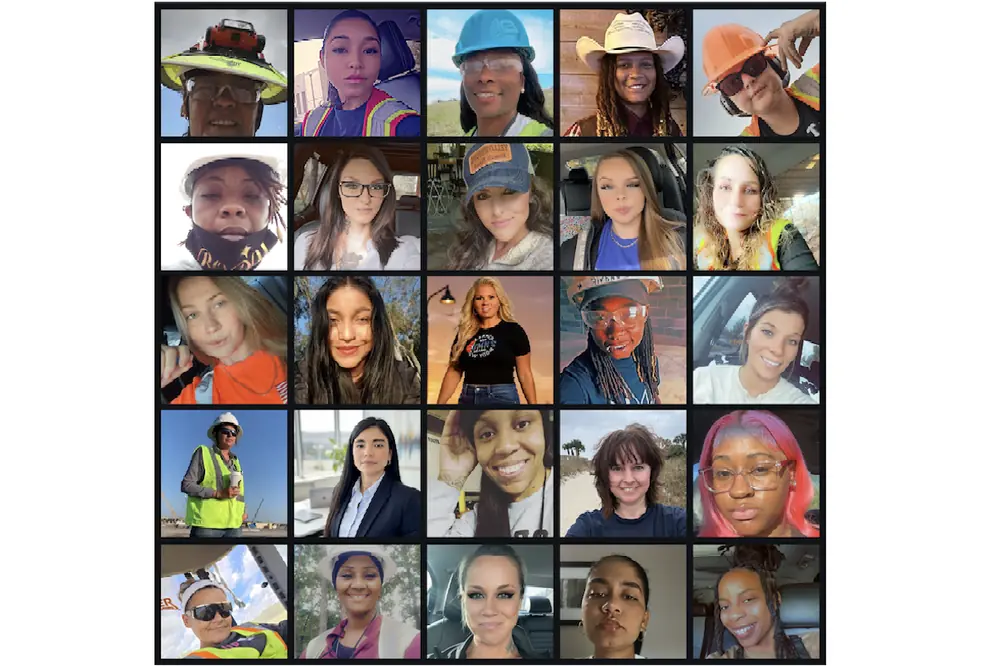

But a tight labor market has caused firms to offer greater compensation to attract and retain talent. Over 8 million job openings remain unfilled, which translates to 1.3 job openings for every unemployed worker. About three-quarters, or 74 percent, of executives in the MMBI survey indicated that they are significantly or somewhat concerned about access to skilled labor; 75 percent said the same about the cost of labor.

It’s no surprise, then, that 57 percent of executives said they had increased compensation in the second quarter and 61 percent expect to do so in the second half of the year.

Just as important, 67 percent of respondents said they expect to pay more for goods and services over the final six months of the year.

In terms of the percentage of executives who are reporting increases for prices received for goods and services for this quarter and the next six months, 52 percent said they had passed along higher costs in the second quarter and 62 percent said they intend to do so in the coming months.

This is another sign that prices have stabilized, albeit at higher levels, and suggests that midsize organizations have made the adjustment to a higher post-pandemic-era level of prices.

Looking ahead, however, executives in the survey expressed doubt about their ability to borrow over the next six months. Only 32 percent expected easier access to capital, down from 43 percent in the first quarter. That figure was consistent with findings in the Federal Reserve’s survey of senior loan officers in the first quarter.

We expect that the middle market outlook on borrowing is tied to uncertainty over when persistently high lending rates will come down.

Federal Reserve Chairman Jerome Powell signaled in May that it may be some time before the Fed is prepared to reduce the benchmark federal funds rate it has held steady at a two-decade-high in the range of 5.25 percent to 5.5 percent since last July.

Firms continue to manage inventory accumulation carefully, with only 40 percent of respondents implying that they increased stocks and 51 percent saying that they intend to do so over the next six months.

This is most likely due to middle market businesses’ attempts to avoid getting too far ahead of consumer demand amid high interest rates, even as inflation continues to cool ahead of the always-critical holiday shopping season.