In many industries that are heavily dependent on commodity prices, like food suppliers and energy producers, there is little choice but to peg prices to the overall market. The costs of making their products are tied too tightly to commodity prices.

But in other industries, the answer is not so straightforward, and those businesses have been grappling with a classic economic trade-off: higher prices mean lower sales.

That’s because lower sales often lead to less market share, which erodes market power and profit margins in the long run. In addition, profit is not always the primary business objective, especially for businesses that prioritize growth or long-run sustainability.

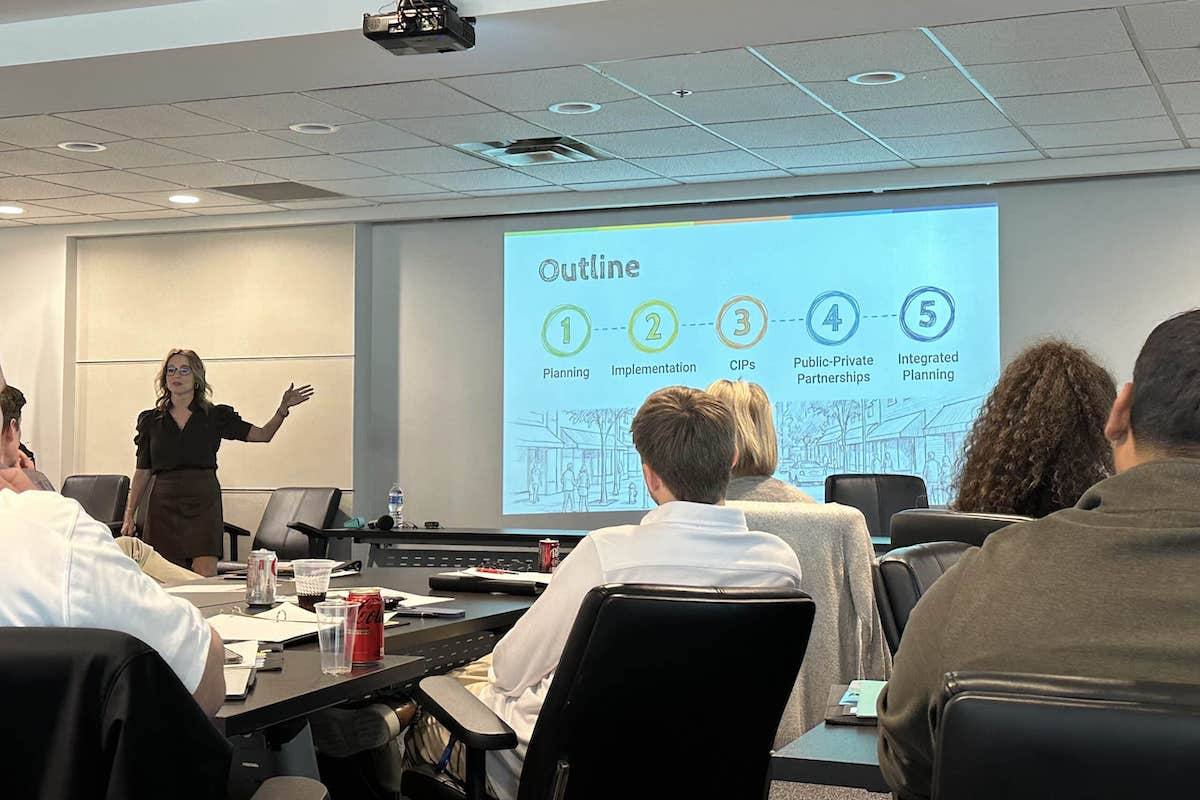

What, then, is a business to do? We examine three important factors that could help business leaders make better pricing decisions: demand forecast, market competition, and business objectives.

| Your local Liebherr Construction Eq dealer |

|---|

| Nueces Power Equipment |

It’s not an easy task, but those methods do not have to be as sophisticated as the approach at Amazon, with its hundreds of economists dedicated to designing pricing and demand algorithms.

Smaller firms can look to high-level macroeconomic data as the foundation to forecast underlying economic trends. The Federal Reserve’s plan to raise interest rates to tame inflation is one example of what can affect overall market demand, as higher interest rates would drive demand to moderate. Data on consumer income, spending, and retail sales – which are released every month and are available at the industry level – is also essential to help predict demand trends.

For example, producers of durable goods are seeing their demand dwindling quite rapidly because consumers are moving away from spending on durable items to services as the impact of the pandemic retreats. The risks of losing demand while raising prices will undoubtedly be much higher for goods producers than service providers.

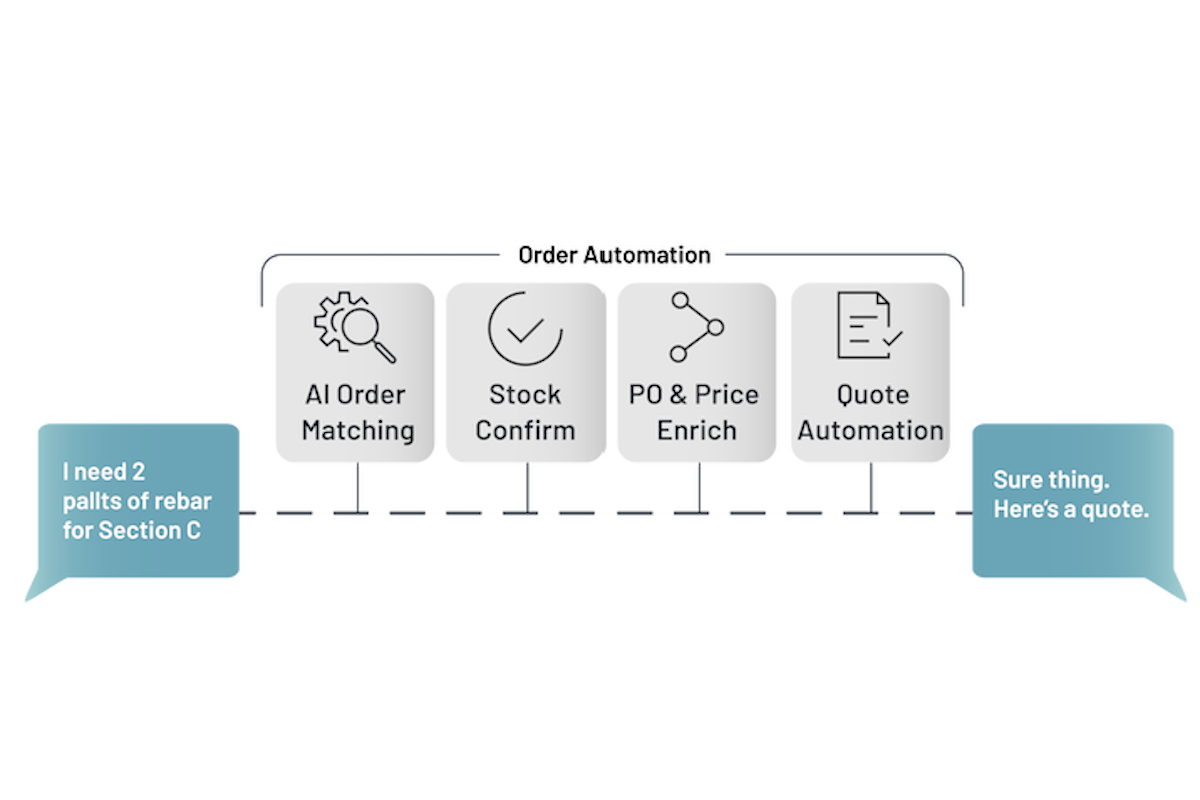

Studying microdata on past and current customer behaviors is the next step to improving a business' demand forecast. For industries where demand often fluctuates because of seasonal factors, capacity constraints or product cycles, dynamic pricing models that incorporate data on demand volatility and consumer sensitivity to price changes can help businesses more nimbly adjust their prices.

For industries where price changes are less frequent, like manufacturing or wholesale, the decision to raise prices should include both short-term and long-term impacts on demand. It is often much more sensitive to prices – the reason why changes in prices are less frequent in the first place.

| Your local Yanmar dealer |

|---|

| CLM Equipment Co |

| WPI |

Lower price variability also means fewer data points to predict demand. Market testing and implementing "what-if" scenarios can provide data-driven and informed solutions to pricing decisions that are less biased than the traditional rule-of-thumb or experience-based pricing methods.

Building a data-driven model to forecast demand can improve upon itself when more data is collected. And that is the reason why companies should start investing their resources early, no matter how limited those resources might be.

Moving first to raise prices in these markets would be a disadvantage unless the company is a dominant player with a high enough market share. Companies that do not have that luxury will have to base their pricing strategies on their competitors' pricing responses.

That requires a certain amount of data on competitors' prices, market share and products to monitor those responses and act quickly. Leveraging publicly available data on competition is a must before making any pricing decisions.

Equally important is identifying the company's specific comparative advantages and the market's barrier to entry. For example, raising prices to protect profit margins would invite innovations and entries from competitors that could chip away market share. Those risks can sometimes be hard to envision yet can seriously affect a company's survival in the long run.

| Your local Hitachi dealer |

|---|

| Bane Machinery |

Market competition can also happen at the supplier level. If there is a dominant firm that supplies input materials for the entire market, chances are your competitors are facing the same problem. Your pricing decisions again should follow your competitors' reactions closely.

But upstream competition can open the door for new opportunities like strategic partnerships, vertical mergers or acquisitions. Instead of fighting higher input costs, companies can take matters into their own hands by having more control over their suppliers. That control can be further expanded into downstream market power by eliminating double marginalization and becoming more efficient.

Protecting profit margins may be less pressing for companies that prioritize growth than protecting market share and locking up more customers. Omnichannel companies that focus on customer experience and direct sales may also need to be more careful when raising prices because of potential customer adverse reactions to higher prices.

But for companies that prioritize recouping profit quickly for new products or face capacity constraints, raising prices should be an easy decision.

Most companies do not rely on a single strategic goal but rather a combination of priorities and business plans. Pricing decisions then become more complex than a simple yes or no question. Those decisions also include questions like by how much and for how long.

| Your local LeeBoy dealer |

|---|

| ASCO Equipment |

| Closner Equipment Co Inc |

| Romco Equipment Co |

By building a strong foundation with the help of data-driven studies to understand the risks, benefits and opportunities around pricing strategy, businesses will be better prepared to make sound decisions. That includes the uncertainties around inflation that might take months or even years to subside.