The high-level overview of the proposed plan calls for $1.3 trillion dollars to be spent on transportation, power, communities (housing, schools, childcare), water, and broadband internet, with remaining amounts slated for significant non-construction infrastructure spending, including research and development and technology, revitalization of small and medium businesses, and workforce development. The push for investment in traditional construction infrastructure will serve as a catalyst for growth in the construction sector, resulting in increased employment and nonresidential spending, both of which have fallen below pre-pandemic levels.

- $115 billion for roadways and bridges and an additional $174 billion for electric vehicle (EV) facilities

- $85 billion for public transit

- $80 billion for Amtrack/freight rail

- $25 billion for airports

- $17 billion for ports and waterways

The significant request for transportation infrastructure is not a surprise. The most utilized form of transportation in the United States is roadways; as the most recent and significant roadway bill (Fixing America’s Surface Transportation Act) expires in September expires, the Biden administration will need a new plan for roadway and bridge upgrades.

The $115 billion requested for roadways will be spent to modernize bridges, highways and other road-related infrastructure in most critical need of repair. According to a 2021 report from American Society of Civil Engineers, 43 percent of public roadways are in poor or mediocre condition, and 7.5 percent of bridges are structurally deficient. As car transportation remains the most popular form of transportation, is it critical the necessary capital improvements are made to fix American’s roads properly and efficiently. A study by INRIX Inc., a leader in mobility analytics, calculated that in 2018, congestion alone cost Americans $87 billion in lost productivity.

Biden’s revitalization plan also outlined a grant-and-incentive program to promote the construction of 500,000 electric-vehicle charging stations across the country by 2030. While the U.S. market for EV represents only about 2.5 percent of the total market (based on monthly new vehicle registrations in December 2020) it is expected to quadruple over the next five years; the need for infrastructure to support this growth will be a critical component in helping to reduce carbon emissions.

| Your local Bobcat dealer |

|---|

| Compact Construction Equipment, Inc |

| Bobcat of North Texas |

| Compact Construction Equipment, Inc |

| Bobcat of North Texas |

Finally, the administration’s plan includes modernizing many of the old and outdated rail lines and waterways, which are in desperate need of repair.

- $100 billion for power

- $111 billion for water

- $100 billion for broadband

- $350 for community development (schools/childcare/etc.)

The vulnerabilities of these infrastructure sectors have been underscored by high-profile events ranging from the Flint, Michigan, water crisis to the more recent disruption of the Texas power grid. Meanwhile, the pandemic has highlighted the need for all Americans to have access to reliable and affordable broadband internet service. Biden’s plan addresses these shortcomings, and includes investments tax credits to incentivize improvements.

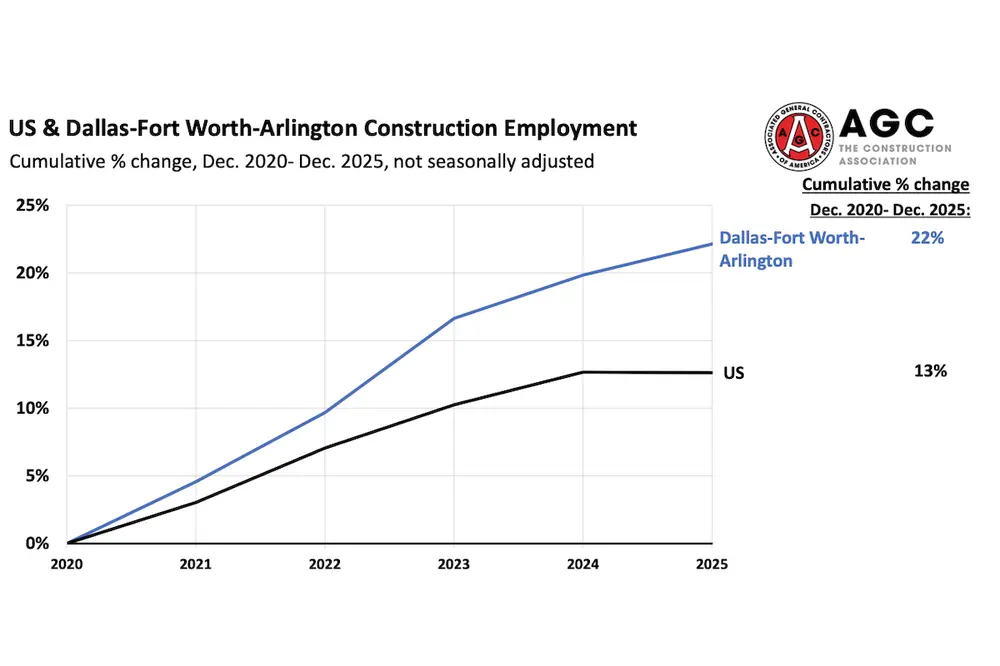

In order to prepare for the anticipated rebirth and redevelopment of America’s infrastructure, construction companies should be looking to invest in new technology both for on the job site and in the back office to take advantage of negative inflation-adjusted interest rates to pay for these long-term investments. Contractors should also be continually evaluating labor and material sourcing needs. One of the most significant industry trends during the post-Great Recession construction boom was shortages of skilled labor. While employment remains below pre-pandemic levels, it would be good for contractors to evaluate personnel across the board and ensure they have the right labor force in place for passage of this plan. With the increase in material prices, contractors also need to evaluate alternative material sources or look to hedge or buy out their jobs to lock in pricing.